bestbrokerforex.online Community

Community

How Do I Buy Partial Shares Of Stock

Fractional share and dollar-based trading is available through Fidelity Mobile® (Basic Trade Ticket). Placing your first buy or sell order in fractional shares. IBKR clients can pick any eligible US, Canadian or European stock (or ETF, where available) and decide how much they want to invest - it's that easy. If the. Fractional shares trading lets you buy portions of a stock or ETF for any amount from $5, so you can own a fraction of a company for less than its stock price. Fractional shares are as their name implies, a fraction of a share or less than one whole share. So, instead of buying one whole share of a company, you can buy. Brokers where you can trade fractional shares allow you to buy just a tiny fraction of an otherwise expensive stock - sometimes as small as $1. Fractional share investing With fractional share trading, you can buy a small slice of a company's stock, rather than buying a whole share. That can make it. To buy fractional shares with margin, you can use your max buying power, and the financing rate is the same as that for whole shares. Please note that. You simply open and fund an account to access fractional shares from an approved list of thousands of stocks and ETFs. Stock Fractions ℠Service Mark lets you buy in dollars instead of shares via the Wells Fargo Mobile® app. shares or partial shares as possible. Which. Fractional share and dollar-based trading is available through Fidelity Mobile® (Basic Trade Ticket). Placing your first buy or sell order in fractional shares. IBKR clients can pick any eligible US, Canadian or European stock (or ETF, where available) and decide how much they want to invest - it's that easy. If the. Fractional shares trading lets you buy portions of a stock or ETF for any amount from $5, so you can own a fraction of a company for less than its stock price. Fractional shares are as their name implies, a fraction of a share or less than one whole share. So, instead of buying one whole share of a company, you can buy. Brokers where you can trade fractional shares allow you to buy just a tiny fraction of an otherwise expensive stock - sometimes as small as $1. Fractional share investing With fractional share trading, you can buy a small slice of a company's stock, rather than buying a whole share. That can make it. To buy fractional shares with margin, you can use your max buying power, and the financing rate is the same as that for whole shares. Please note that. You simply open and fund an account to access fractional shares from an approved list of thousands of stocks and ETFs. Stock Fractions ℠Service Mark lets you buy in dollars instead of shares via the Wells Fargo Mobile® app. shares or partial shares as possible. Which.

Trading fractional shares? · Go to an individual stock's detail page · Enter the amount to trade · Review and submit the order. *There is a minimum of shares per order and a purchase quantity of $5 to own a portion of the stock or ETF. Own part of a stock. Invest in your favorite. Orders to sell may be entered using a fractional share quantity (e.g., shares). Orders to buy may use either a fractional quantity or a dollar value. . Orders to sell may be entered using a fractional share quantity (e.g., shares). Orders to buy may use either a fractional quantity or a dollar value. . When you buy fractional shares with Stash, you can choose your own stocks, set up automated recurring investments, or contribute to a retirement account. A fractional (partial) share is what it sounds like—you buy a fraction of a share instead of a whole share. It's a great way to get into investing without. Invest in any stock in the S&P ® for as little as $5 using fractional shares. Schwab Stock Slices. Read PDF: How to buy Schwab Stock Slices. Related. Fractional shares are partial shares of a company's stock. Instead of buying a whole share, you're only buying a part, or a fraction, of a share. A fractional share is when a full single share is split. For example, fractional shares occur during stock splits, dividend reinvestment plans, or various. Fractional shares give investors a simple way to build a balanced portfolio and invest in shares regardless of the share price. With fractional shares. Fractional share investing allows you to put even the smallest amount of cash to work in the market. Considering that some popular stocks trade at $1, or. The whole share component of any order will be executed by NFS as agent at the price NFS receives in the market. The fractional share component. All my stuff is in fractional shares. It's easy to do in Fidelity. Just tell it how much you want to spend and it will complete the order. Fractional investing allows you to buy portions of shares instead of purchasing an entire share. With fractional shares, you can invest as little as you. Partial shares allow you to invest in the stocks you want, regardless of the share price. There are thousands of stocks and ETFs available for partial share. With fractional shares you can divide your investments among more stocks to achieve a more diversified portfolio, and put small cash balances to work quickly. A fractional share is a part of one share of stock or of an exchange-traded fund (ETF). For example, if the price of a stock is $ and you invest $10, you. Closing fractional shares If you decide to close your entire position, you must submit two separate closing orders. One order to close the whole share amount. By buying in fractions, if a company's stock is selling at $1, a share and you invest $, you would own a 20 percent fraction or, put differently, a Orders to sell may be entered using a fractional share quantity (e.g., shares). Orders to buy may use either a fractional quantity or a dollar value. .

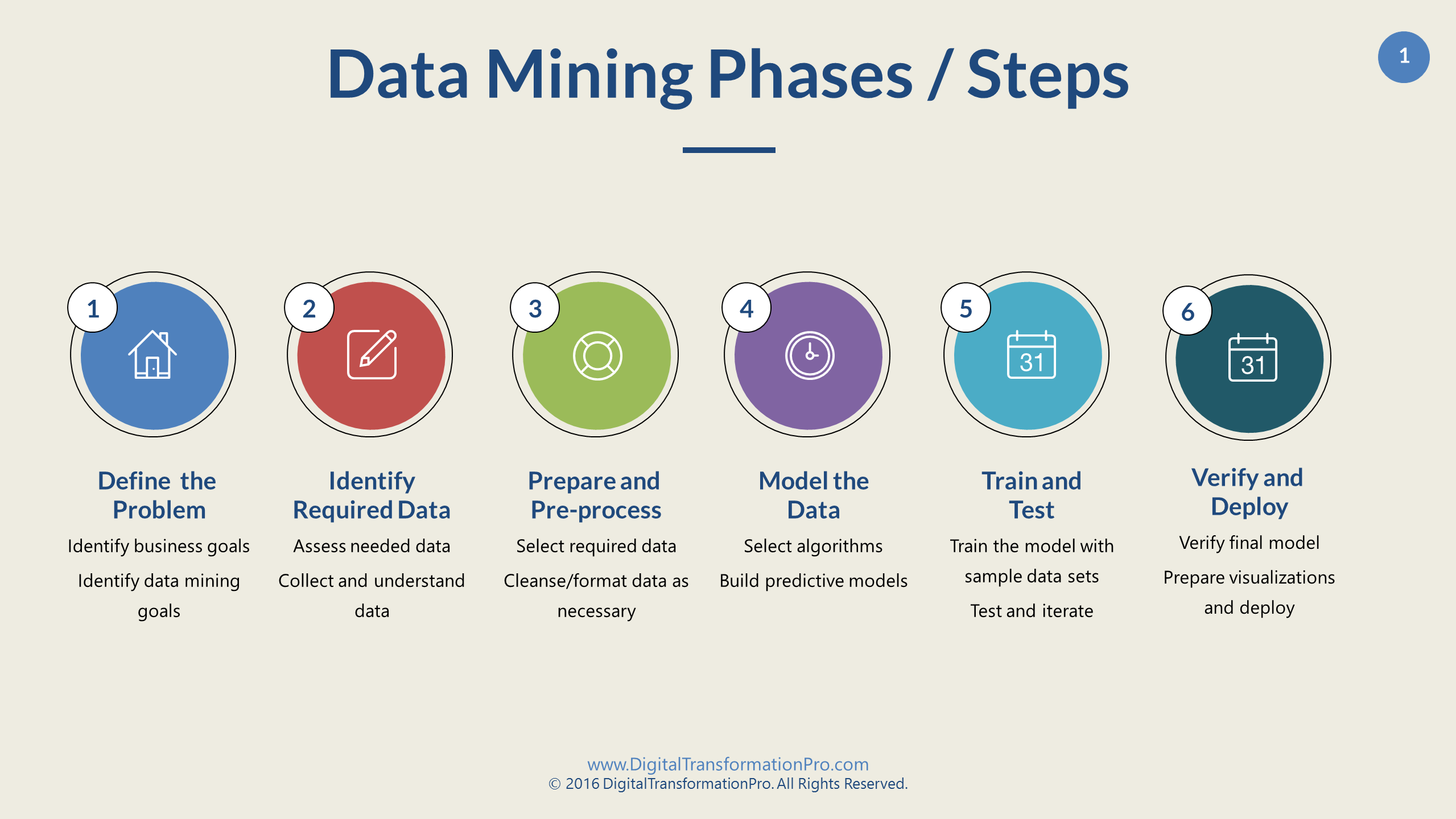

How Does Digital Mining Work

Cryptocurrency mining is a process that validates transactions and adds them to a blockchain. Miners use computational power to solve complex mathematical. works for me. I love this app, and developers did an amazing job! more. Kellan Rhys, 04/09/ Just buy Bitcoin. So I use this app for approximately 3 1/2. Mining is the process that Bitcoin and several other cryptocurrencies use to generate new coins and verify new transactions. How does bitcoin mining work? No central authority oversees or regulates the Bitcoin process. Bitcoin miners confirm and verify transactions by solving. Mine optimization is a priority for digital algorithms and machine learning devices designed precisely for the job. From exploration all the way to mine closure. Investing involves risk, including risk of loss. Fidelity Crypto℠ is offered by Fidelity Digital Assets℠. Crypto is highly volatile, can become illiquid at any. Cryptocurrency mining uses specialized computing resources to add blocks to a proof-of-work (PoW) blockchain. Mining is essential on Proof of Work blockchains like Bitcoin's. Newer blockchains tend to use Proof of Stake and other consensus mechanisms, and they do not. Crypto mining is the process by which crypto miners use computers, data, codes, and calculations to validate crypto currency transactions. Cryptocurrency mining is a process that validates transactions and adds them to a blockchain. Miners use computational power to solve complex mathematical. works for me. I love this app, and developers did an amazing job! more. Kellan Rhys, 04/09/ Just buy Bitcoin. So I use this app for approximately 3 1/2. Mining is the process that Bitcoin and several other cryptocurrencies use to generate new coins and verify new transactions. How does bitcoin mining work? No central authority oversees or regulates the Bitcoin process. Bitcoin miners confirm and verify transactions by solving. Mine optimization is a priority for digital algorithms and machine learning devices designed precisely for the job. From exploration all the way to mine closure. Investing involves risk, including risk of loss. Fidelity Crypto℠ is offered by Fidelity Digital Assets℠. Crypto is highly volatile, can become illiquid at any. Cryptocurrency mining uses specialized computing resources to add blocks to a proof-of-work (PoW) blockchain. Mining is essential on Proof of Work blockchains like Bitcoin's. Newer blockchains tend to use Proof of Stake and other consensus mechanisms, and they do not. Crypto mining is the process by which crypto miners use computers, data, codes, and calculations to validate crypto currency transactions.

We are Stronghold Digital Mining - the only environmentally beneficial and vertically integrated public Bitcoin mining company. Bitcoin mining is a competition to add blocks, or secure financial records, to the blockchain ledger. Miners do this by racing to guess a digit hexadecimal. Bitcoin mining involves using a computer to solve difficult mathematical equations for the user to earn bitcoin. Learn how bitcoin mining works and its. With Bitcoin mining operations in the United States, Canada, and Iceland, and diversified revenue streams in Ethereum staking, Bit Digital has expanded its. Miners act to either create a new currency (eg, a new coin or token in the BitCoin network) or block on the chain to match and validate ongoing transactions. As you can imagine, this type of mining doesn't involve callused hands gripping pickaxe handles. Instead, it's computer processors that do all the hard work. How does Bitcoin mining work? Like gold miners using picks and shovels to extract gold, a Bitcoin miner needs two things: mining hardware and energy. Miners. When people mine crypto, they are using computers (usually graphics cards) to try and solve these complex problems first so they can be the person who adds the. We'll help you create measureable improvements that deliver next-level performance enhancements throughout the entire mining value chain, from the ore body to. A mining pool is a group of crypto miners who pool their resources and share rewards. By working together, miners are much more likely to get the chance to mine. When a correct solution is reached, a reward in the form of bitcoin and fees for the work done is given to the miner(s) who reached the solution first. This. Cryptocurrency mining is the way that proof-of-work cryptocurrencies validate transactions and mint new coins. It was the first method used that enabled. Bitcoins are a cryptocurrency created through a process called 'mining', where miners are required to solve (mine) a complex mathematical puzzle before they. Miners play a crucial role in validating transactions and securing the network by solving complex mathematical puzzles. This process ensures the. Digital Mine offers an end-to-end solution which helps mining and metals companies realize the productivity benefits of digital transformation faster. How does Bitcoin mining work? · 1. New transactions are broadcast to all nodes. · 2. Each node collects new transactions into a block. · 3. Each node works on. How Do Bitcoin Transactions Work? The process is: 1. Make a payment (a bitcoin transaction). 2. Wait for it to be mined. Each miner competes with other miners to solve challenging mathematical equations called hash puzzles. Miners use advanced computer hardware to do this. Discover how Gryphon Digital Mining is leading the way in sustainable, carbon neutral Bitcoin mining. $ GRYP share price in USD. Bitcoin mining refers to the process of digitally adding transaction records to the blockchain, which is a publicly distributed ledger holding the history of.

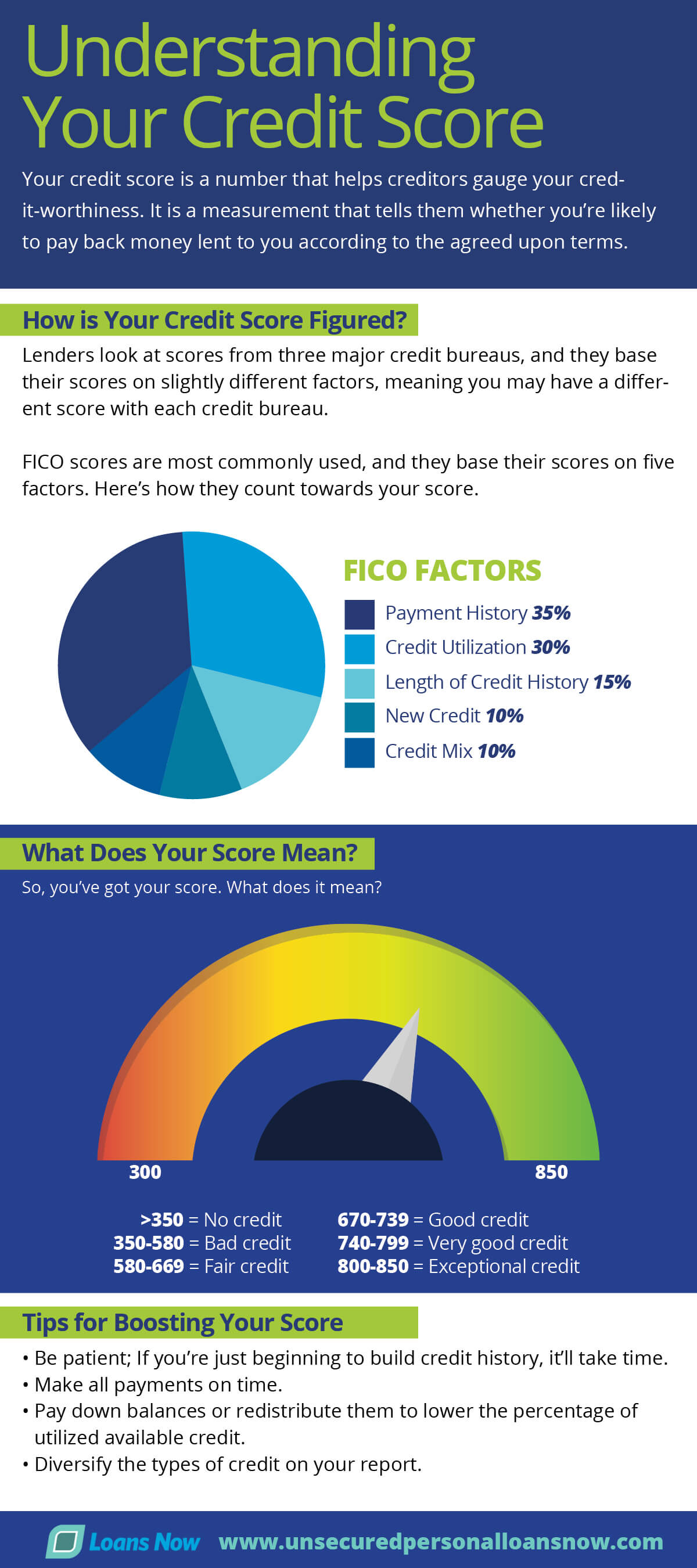

Should I Use Personal Loan To Pay Off Credit Card

Pay off debt sooner: A lower interest rate means there could be more money to direct to paying down existing debt, potentially allowing the debtor to get out. This introductory rate allows you to put more money toward paying down the principal amount of your debt and less toward compounded interest. However, balance. If you decide to take this route, it's important to use a personal loan as a means to an end. Even if you use one to pay off your debt, you could quickly find. For most people, the best way to pay down credit cards is to start with the lowest balance and work your way up. However, there are other tactics you can take. One of the major benefits of paying off credit card debt with a personal loan is that individuals can bring multiple debts under one loan, reducing the number. With both personal loans and credit cards, you can receive funds from a lender at a specified interest rate. Then you make monthly payments that include. Pros Of Getting A Loan To Pay Off Debt · You could get a lower interest rate with a personal loan. · You may have only one fixed monthly payment to worry about. A personal loan can be used for a variety of purposes, even for debt consolidation! Try our personal loan calculator to estimate your payments to manage. Yes. Many people take a personal loan to pay off their credit card debt. The main reason is the lower interest rate on a personal loan than on a. Pay off debt sooner: A lower interest rate means there could be more money to direct to paying down existing debt, potentially allowing the debtor to get out. This introductory rate allows you to put more money toward paying down the principal amount of your debt and less toward compounded interest. However, balance. If you decide to take this route, it's important to use a personal loan as a means to an end. Even if you use one to pay off your debt, you could quickly find. For most people, the best way to pay down credit cards is to start with the lowest balance and work your way up. However, there are other tactics you can take. One of the major benefits of paying off credit card debt with a personal loan is that individuals can bring multiple debts under one loan, reducing the number. With both personal loans and credit cards, you can receive funds from a lender at a specified interest rate. Then you make monthly payments that include. Pros Of Getting A Loan To Pay Off Debt · You could get a lower interest rate with a personal loan. · You may have only one fixed monthly payment to worry about. A personal loan can be used for a variety of purposes, even for debt consolidation! Try our personal loan calculator to estimate your payments to manage. Yes. Many people take a personal loan to pay off their credit card debt. The main reason is the lower interest rate on a personal loan than on a.

Paying off and consolidating credit card debt Credit cards tend to have higher interest rates than other types of consumer loans, and you could save money by. Personal loans are effective because they charge lower interest rates than credit cards, and this saves the user interest and paying off the loan is quicker. Instead, Dave Ramsey tells you, as part of your "Baby Steps," you should accelerate payments to your credit card companies to get out of debt. His advice is to. A personal loan to pay off credit cards With a simple interface and quick application process, The Payoff Loan™ streamlines paying off credit card debt. A personal loan or a credit card can be a good option, depending on how much money you need and how quickly you can pay it back. Generally, personal loans are. Instead, Dave Ramsey tells you, as part of your "Baby Steps," you should accelerate payments to your credit card companies to get out of debt. His advice is. One reason getting a loan to pay off debt makes sense is if you have multiple credit cards, each with its own due dates, payment amounts, and interest rates. Therefore, if you pay off a personal loan early, you could bring down your average credit history length and your credit score. How much of a change in your. Using a personal loan to pay off your credit card debt can lower interest rates and consolidate your payments. But there are alternative debt relief options. Still paying high interest rates on your credit cards? Consolidating your credit card debt can help save you money every month with fixed rates and a known. Pay off debt sooner: A lower interest rate means there could be more money to direct to paying down existing debt, potentially allowing the debtor to get out. Paying off a loan with a credit card will depend on the lender and the type of loan. If your lender allows it and you are given enough of a credit limit. Using a personal loan to pay off your credit card debt may help you get on top of what you owe. It's a good idea to speak to your current lender first to see. Using a personal loan to pay off your credit card debt can lower interest rates and consolidate your payments. But there are alternative debt relief options. Why Pay Off Credit Cards With a Personal Loan? ; Lock in a Fixed Rate. With competitive rates, your monthly payment never increases. ; Pay Down Your Debt. With. Using a personal loan to pay off credit card debt is a smart way to rid yourself of those high interest rates. Credit card debt can be a big roadblock on. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come. Key takeaways · Having a strategy paying off your credit card debt helps save you time and money. · Pay off credit cards with a high interest rate first to. Fortunately, you may be able to use a personal loan to pay off your credit card debt, and ideally net yourself a lower interest rate, which can put you on the. A personal loan can be used for a variety of purposes, even for debt consolidation! Try our personal loan calculator to estimate your payments to manage.

Need For Financial Advisors

Required Education for a Financial Planner. Companies may expect financial planners to possess bachelor's degrees, at minimum. Hiring managers may prefer an. By getting to know you, your family, and your feelings about investing and your future, an advisor can better plan for your specific needs and help you adjust. By planning ahead for life's big events, you can be better positioned to reach your financial goals — and more prepared to meet any unexpected challenges. need pursuing CFP Mission Wealth has been recognized as a Best Place to Work for Financial Advisors as announced by InvestmentNews. Learn how a Financial Advisor can work with you to build a wealth plan that helps you reach your goals. We all have goals—and many are linked to our finances. CFP® designation candidates must have a degree from an accredited post-secondary institution – in any discipline, although a focus on business or finance is. You don't need a financial planner if you are knowledgeable enough. Relatively high earner, struggling with financial advisors/life insurance/. The average U.S. life expectancy is , and the top financial worry for 30%2 of retirees is outliving their savings. Your investment portfolio needs to. The fiduciary standard calls for advisors to place the best interests of their clients first. While registered investment advisors are legally required to. Required Education for a Financial Planner. Companies may expect financial planners to possess bachelor's degrees, at minimum. Hiring managers may prefer an. By getting to know you, your family, and your feelings about investing and your future, an advisor can better plan for your specific needs and help you adjust. By planning ahead for life's big events, you can be better positioned to reach your financial goals — and more prepared to meet any unexpected challenges. need pursuing CFP Mission Wealth has been recognized as a Best Place to Work for Financial Advisors as announced by InvestmentNews. Learn how a Financial Advisor can work with you to build a wealth plan that helps you reach your goals. We all have goals—and many are linked to our finances. CFP® designation candidates must have a degree from an accredited post-secondary institution – in any discipline, although a focus on business or finance is. You don't need a financial planner if you are knowledgeable enough. Relatively high earner, struggling with financial advisors/life insurance/. The average U.S. life expectancy is , and the top financial worry for 30%2 of retirees is outliving their savings. Your investment portfolio needs to. The fiduciary standard calls for advisors to place the best interests of their clients first. While registered investment advisors are legally required to.

Studies show women prefer working with female financial advisors, yet only 15% of financial advisors in Canada are women. Not only is it a missed opportunity. Certified Financial Planner (CFP) certification is becoming a standard requirement for most financial planning roles at financial institutions. Many job. Interview clients to determine their current income, expenses, insurance coverage, tax status, financial objectives, risk tolerance, or other information needed. “CFP's can help people who need a strategy to pay off loans or need ways to generate income,” he said. “They can also help young families settling down, mid-. Earning it demands several years in financial planning, a formal degree, clearing the CFP exam and adhering to high ethical standards. You must also act as a. By taking a comprehensive look at your business planning, taxes, investments, and retirement needs, a financial advisor for business owners can help you clarify. Most importantly, a Financial Planner must be able to communicate effectively, particularly when dealing with the complex needs of high-net-worth individuals. Realistically no you don't need anyone to actively manage your money. Now having a CFP that you meet with yearly or twice a year may be helpful. What does a business financial advisor do and how can they help me? · Business owners need a personal financial advisor. · Financial advisors lead business owners. Your ability to understand the financial plan you've set out, stick to it and adjust when needed will be key to your success. But each of us is unique and have. An advisor can help you figure out your savings, how to build for retirement, help with estate planning, and others. If however you only need to discuss. A financial advisor can help you invest your money, plan for major life events and preserve your wealth for future generations of your family. Required Education for a Financial Planner. Companies may expect financial planners to possess bachelor's degrees, at minimum. Hiring managers may prefer an. A bachelor's degree is commonly required. Having certification and a master's degree can improve one's chances to advance in this field. Education & Training. A. Questions Great Financial Advisors Ask and Investors Need to Know: Parisse, Alan, Richman, David: Books - bestbrokerforex.online “CFP's can help people who need a strategy to pay off loans or need ways to generate income,” he said. “They can also help young families settling down, mid-. This page will provide you the information you need to start your journey. Being an independent financial advisor can be a rewarding and satisfying career. Comprehensive financial planning can be achieved, in the most tax-efficient way, with the help of a certified financial advisor. Plus, a strong financial plan. When you need a la carte money advice, a fee-only financial planner can be an affordable choice with no strings attached. Some people have steady, lifelong. Financial advisors love to work with people and develop long-term investment advice and prefer to deal with one advisor for all their financial needs.

Mit Ai Course Free

Still unsure? Try a course for free. Free online courses. Connect, learn, and succeed online. Get up to 30% off with code EDXLEARN Offer ends October 1. Master artificial intelligence for advanced problem-solving. Learn about machine learning, neural networks, and AI applications. OpenAI in collab with DeepLearning is offering this course taught by Isa Fulford and Andrew Ng. Start off with best practices and finish with a. MIT xPRO's online learning programs leverage vetted content from world-renowned experts to make learning accessible anytime, anywhere. MIT OpenCourseWare is a web based publication of virtually all MIT course content. OCW is open and available to the world and is a permanent MIT activity. Artificial Intelligence. MIT has played a leading role in the rise of AI and Our goal is to ensure businesses and individuals have the education and training. MIT's AI courses are now free! No payment required. 10 courses to help you level-up in Beginner: 1. Understand the World Through Data. The Day of AI curriculum was developed by a team of researchers at MIT RAISE, and designed to be taught by educators with little or no technology background. Browse free online courses in a variety of subjects. Massachusetts Institute of Technology courses found below can be audited free or students can choose to. Still unsure? Try a course for free. Free online courses. Connect, learn, and succeed online. Get up to 30% off with code EDXLEARN Offer ends October 1. Master artificial intelligence for advanced problem-solving. Learn about machine learning, neural networks, and AI applications. OpenAI in collab with DeepLearning is offering this course taught by Isa Fulford and Andrew Ng. Start off with best practices and finish with a. MIT xPRO's online learning programs leverage vetted content from world-renowned experts to make learning accessible anytime, anywhere. MIT OpenCourseWare is a web based publication of virtually all MIT course content. OCW is open and available to the world and is a permanent MIT activity. Artificial Intelligence. MIT has played a leading role in the rise of AI and Our goal is to ensure businesses and individuals have the education and training. MIT's AI courses are now free! No payment required. 10 courses to help you level-up in Beginner: 1. Understand the World Through Data. The Day of AI curriculum was developed by a team of researchers at MIT RAISE, and designed to be taught by educators with little or no technology background. Browse free online courses in a variety of subjects. Massachusetts Institute of Technology courses found below can be audited free or students can choose to.

This course introduces principles, algorithms, and applications of machine learning from the point of view of modeling and prediction. The in-person edition has completed and was held in MIT Room The online edition of the course is live on Monday at 10am ET, every week! Subscribe. Learn to use machine learning in Python in this introductory course on artificial intelligence. Price. Free*. Duration. 7 weeks long. Registration Deadline. Most people are silent. More time for me to ask my questions! The AI aspects of the course are not quite guided or driven. But I used AI a ton. This course introduces students to the basic knowledge representation, problem solving, and learning methods of artificial intelligence. MIT OpenCourseWare offers free online courses in mechanical engineering, political science, and music history taught by this. MIT OpenCourseWare is an initiative to make course materials from all MIT subjects freely available on the web, so that anyone can access and use them. Fortune compiled a list of a few free online classes, from places like IBM and Harvard, that cover AI topics for beginners. This course will introduce efficient deep learning computing techniques that enable powerful deep learning applications on resource-constrained devices. MITOCW provides free learning materials from @MIT's classes. No sign-up or You still have a few days to join MIT Open Learning's AI + Open Education. The MIT deep learning course is free on youtube. It's absolutely fantastic and there are three years worth. Highly recommended. More than courses are available for free, and here you have a list of some of the most relevant AI and Machine Learning courses to begin. This course is the first of a two-course sequence: Introduction to Computer Science and Programming Using Python, and Introduction to. These best generative AI courses offer professionals at all levels, from beginners to advanced, a way to improve their skills in generative AI and related. Artificial Intelligence. MIT has played a leading role in the rise of AI and Our goal is to ensure businesses and individuals have the education and training. In AI , MIT researcher Brandon Leshchinskiy offers an introduction to artificial intelligence Course Info. Instructor. Brandon Leshchinskiy. Call for proposals on AI and Education! The MIT OpenCourseWare Collaborations Program is thrilled to announce the AI + Open Education Initiative at MIT Open. Learn artificial intelligence with our free AI courses. They cover essential topics like machine learning, neural networks, and natural language processing. A free and open online publication of educational material from thousands of MIT courses, covering the entire MIT curriculum. The course is completely free for students and it is fully financed by Santander Bank. Are there any technical requirements to access the course?

How Do You Calculate How Much Mortgage You Can Afford

Affordability Calculation Factors. Income. First, add up the income that will be used to qualify for the mortgage, including bonuses and commissions. A simple. Use the home affordability calculator to help you estimate how much home you can afford. Calculate your affordability. Note: Calculators. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Financial advisors recommend spending no more than 28% of your gross monthly income on housing and 36% on total debt. Using the 28/36 rule, if you earn. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. If you have significant credit card debt or other. The rule of thumb still stands: 20% of the home value is the ideal amount of money for a down payment. This amount buys you equity in the home, which helps. Affordability Calculation Factors. Income. First, add up the income that will be used to qualify for the mortgage, including bonuses and commissions. A simple. Use the home affordability calculator to help you estimate how much home you can afford. Calculate your affordability. Note: Calculators. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Financial advisors recommend spending no more than 28% of your gross monthly income on housing and 36% on total debt. Using the 28/36 rule, if you earn. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. If you have significant credit card debt or other. The rule of thumb still stands: 20% of the home value is the ideal amount of money for a down payment. This amount buys you equity in the home, which helps.

The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. To calculate this percentage, multiply your gross monthly income by For example, if your gross monthly income is $5,, your housing expenses should not. SmartAsset's mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you. The oldest rule of thumb says you can typically afford a home priced two to three times your gross income. So, if you earn $,, you can typically afford a. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Use our home affordability tool to estimate how much house you can afford considering closing costs, mortgage, and additional fees and taxes. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. This amount should follow the 28/36 rule; it should be no more than 28% of your gross income, and no more than 36% of your total debt. If you already know what. How much house can I afford based on my salary? Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on. Key Takeaways · The general rule is that you can afford a mortgage that is 2x to x your gross income. · Total monthly mortgage payments are typically made up. Want to know how much house you can afford? Use our home affordability calculator to determine the maximum home loan amount you can afford to purchase. Deciding how much house you can afford. If you're not sure how much of your income should go toward housing, start with the 28/36 rule, which dictates you spend. If you have a spouse or a partner that has an income which will also contribute to the monthly mortgage, make sure to include that as well into your gross. Knowing how much house you can afford is a matter of comparing your financial situation to the factors lenders consider when approving a mortgage application. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Basic mortgage affordability factors include your monthly income, other debt obligations, and credit score. Your lender will compare the money coming in to the. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you.

Best Bank For Boat Loans

Whether you're hitting the water to relax or want to reel in the big one, let Simmons Bank help you finance the boat that is right for you. Competitive rates. Boat Loans ; Boat Loan Calculator by Discover Boating. Boat Loan Calculator. Boat Loans by Boat US ; LightStream for Best Loan Experience Guaranteed. Best Loan. A closer look at our top boat loan lenders ; LightStream: Best overall boat loan. LightStream. Rating: stars out of 5 ; Upstart: Best for low or no credit. Marine Loans · We can help get you on the water with terms tailored to you. · Your Bank. Our Community. Stronger Together. A boat loan from us means smooth sailing! Get competitive vehicle loan rates at Suffolk Credit Union in Long Island, NY. Learn more and apply online now. Get a fixed-rate loan with a term up to 15 years¹ ( months) with Mountain America Credit Union. We offer flexible financing terms and some of the best boat. Set sail with a boat loan from Greater Texas Credit Union. Enjoy flexible terms and easy payments to finance your new or used boat. JJ Best Banc & Co. boat loans provide flexible financing to purchase or refinance new or used boats with competitive boat loan interest rates. As of September , the best interest rates for boat loans typically start around %. On Thursday morning, our loan was funded by the bank! The. Whether you're hitting the water to relax or want to reel in the big one, let Simmons Bank help you finance the boat that is right for you. Competitive rates. Boat Loans ; Boat Loan Calculator by Discover Boating. Boat Loan Calculator. Boat Loans by Boat US ; LightStream for Best Loan Experience Guaranteed. Best Loan. A closer look at our top boat loan lenders ; LightStream: Best overall boat loan. LightStream. Rating: stars out of 5 ; Upstart: Best for low or no credit. Marine Loans · We can help get you on the water with terms tailored to you. · Your Bank. Our Community. Stronger Together. A boat loan from us means smooth sailing! Get competitive vehicle loan rates at Suffolk Credit Union in Long Island, NY. Learn more and apply online now. Get a fixed-rate loan with a term up to 15 years¹ ( months) with Mountain America Credit Union. We offer flexible financing terms and some of the best boat. Set sail with a boat loan from Greater Texas Credit Union. Enjoy flexible terms and easy payments to finance your new or used boat. JJ Best Banc & Co. boat loans provide flexible financing to purchase or refinance new or used boats with competitive boat loan interest rates. As of September , the best interest rates for boat loans typically start around %. On Thursday morning, our loan was funded by the bank! The.

In addition to customized yacht financing, Bank of America Private Bank offers access to sophisticated credit capabilities and a depth of resources, experience. UCCU offers low rates and flexible terms on every loan. Learn more about boat loans and how UCCU can help. Steer your way out onto the water with a boat loan from First Citizens. We offer competitive rates and fast access to funds. Apply for a watercraft loan. Best Day · Books & Movies · Cockpit Confessions · Communication The buyer and seller do not need to visit a bank or be in the same place to close the loan. SoFi is our top overall choice for boat loans. It's great if you're looking for: Loan terms of up to seven years. Our Croghan Marine Finance Specialist is dedicated to the sole mission of meeting the lending needs of current and future boaters along the shores of Lake Erie. OceanPoint Marine Lending provides competitive rates, dedicated buyer support and quick access to funds to make sure you are on the water when you want to be. BankFive in MA and RI offers competitive rates on boat loans including sailboats, yachts, powerboats, and more. Apply for a loan today. Peoples Bank offers lending services for borrowers in Washington, Alaska, Oregon, and California. We provide financing for new and used recreational vessels. boat loans. Set course for maritime adventures with flexible financing marine lenders to get the best possible rate for each boat loan. And we. Love banking with Gulf Winds Credit Union!! Bonnie A. Boat Loan Benefits. Whether you want to fish or. Innovative loan features like Anytime Skip-A-Pay, GAP coverage, Debt Protection, and no origination fees make Seattle Credit Union's Boat Loans among the best. Easy Payments. You can make loan payments however it suits you best. Set up banking. Whatever you choose! Make A Loan Payment. Car on the side of the. is pretty good today. Car loans are hitting 6%+ and luxury items (boats and RVs) are normally a couple points higher. I'd expect to be mid 8's. Explore Boat Loans · Apply Now. Save a boatload of money when you finance Bank online or visit us one of our Metro Detroit locations today: in Ann. boat with a boat loan from MidFirst Bank Save time and money with preapproved financing from MidFirst Bank and negotiate the best deal for your new or used. Whether you're fishing for a derby winner or exploring the scenic coastline, First Bank can help you build your dream boat. Our knowledgeable lenders are. You can make your loan payments through cuAnywhere® Online Banking and the Advancial Mobile App. Tipping is a way to show appreciation for good service. FFCCU offers advice, experience, and competitive rates on boat financing and jet ski loans. Our goal is to help you find the best path to enjoying the open.

How Does Ec2 Work

EC2 (short for "Elastic Compute Cloud") is a hugely successful service at the very core of the AWS platform that allows you to effectively rent. In this tutorial, you will provision an EC2 instance on Amazon Web Services (AWS). EC2 instances are virtual machines running on AWS, and a common component of. EC2 works by pooling resources together in the cloud and providing logically separated virtual machines for thousands of customers. You can get. How does AWS EMR work? Amazon EMR service consists of several components: compute, storage, and cluster resource management. Storage in EMR cluster. There are. CloudWatch does not expose metrics related to EC2 instance memory. You can install Elastic Agent on the EC2 instances to collect detailed system metrics. What is AWS EC2? How does AWS EC2 work? AWS Elastic Compute Cloud (EC2) use cases. Troubleshooting AWS EC2 performance. Amazon EC2 provides developers the tools to build failure resilient applications and isolate them from common failure scenarios. Getting started with AWS is. Amazon Web Services (AWS) EC2 Instances are virtual computers that you create to perform processing operations in place of using your desktop or laptop. EC2 reduces the time required to boot and obtain new server instances i.e. Amazon EC2 instances. It allows scaling capacity as per the computing requirements. EC2 (short for "Elastic Compute Cloud") is a hugely successful service at the very core of the AWS platform that allows you to effectively rent. In this tutorial, you will provision an EC2 instance on Amazon Web Services (AWS). EC2 instances are virtual machines running on AWS, and a common component of. EC2 works by pooling resources together in the cloud and providing logically separated virtual machines for thousands of customers. You can get. How does AWS EMR work? Amazon EMR service consists of several components: compute, storage, and cluster resource management. Storage in EMR cluster. There are. CloudWatch does not expose metrics related to EC2 instance memory. You can install Elastic Agent on the EC2 instances to collect detailed system metrics. What is AWS EC2? How does AWS EC2 work? AWS Elastic Compute Cloud (EC2) use cases. Troubleshooting AWS EC2 performance. Amazon EC2 provides developers the tools to build failure resilient applications and isolate them from common failure scenarios. Getting started with AWS is. Amazon Web Services (AWS) EC2 Instances are virtual computers that you create to perform processing operations in place of using your desktop or laptop. EC2 reduces the time required to boot and obtain new server instances i.e. Amazon EC2 instances. It allows scaling capacity as per the computing requirements.

Rather than you previously buy physical servers, you would look for a server that has more CPU capacity, RAM capacity and you buy a server over 5 year term, so. How to run systems in EC2? · After selecting a suitable option in EBS, we give the instance a name and then we create a security group. · A. An AWS security group acts as a virtual firewall for your EC2 instances to control incoming and outgoing traffic. Both inbound and outbound rules control the. An advantage of using Amazon Elastic Compute Cloud (EC2) is the ability to start, stop, create, and terminate instances at any time. EC2 setup involves creating an Amazon Machine Image (AMI), which includes an operating system, apps, and configurations. That AMI is loaded to the Amazon Simple. Elastic Cloud Compute (EC2) instances are one of their core resource offerings, and they form the backbone of most cloud deployments. EC2 instances provide you. Amazon Elastic Compute Cloud (EC2) is a part of Amazon's cloud-computing platform, Amazon Web Services (AWS), that allows users to rent virtual computers on. Elastic Cloud Compute (EC2) instances are one of their core resource offerings, and they form the backbone of most cloud deployments. EC2 instances provide you. Amazon Web Service, or AWS, is an online platform providing cost-effective, scalable cloud computing solutions. It offers a range of on-demand operations, such. An Amazon EC2 Instance is a virtual server within Amazon's EC2, a service in the AWS cloud. Learn about Amazon EC2 instance types, features and pricing. How Amazon EC2 works · In the Amazon EC2 console navigation pane, choose Instances. · Select the EC2 instance -- where the connection is required -- and choose. How does Amazon EC2 work? Amazon Elastic Compute Cloud (EC2) is a web service that provides secure, resizable compute capacity in the cloud. Basically, EC2. With AWS, you pay for this model by the hour or by the second. On-demand saves you from the dreaded business of planning ahead and actually. Your Amazon EC2 usage is calculated by either the hour or the second based on the size of the instance, operating system, and the AWS Region where the instances. How does Amazon EC2 work? Amazon Elastic Compute Cloud (EC2) is a web service that provides secure, resizable compute capacity in the cloud. Basically, EC2. Learn about some of the advantages of using Amazon Web Services Elastic Compute Cloud (EC2). Then, the first part of the tutorial covers how to launch and. When you connect to an instance using EC2 Instance Connect, the Instance Connect API pushes a one-time-use SSH public key to the instance. How does EC2 work? EC2 provides virtual servers, known as instances, for compute capacity. Users can choose the size, power, memory capacity, and number of. An EC2 instance acts as a virtual server hosted in the Amazon Web Services (AWS) cloud. There are many types of EC2 instances, each can be customized to the.

715 Credit Score Personal Loan

Is It Worth Taking Out a Personal Loan to Pay Off Credit Card Debt? 92 upvotes · 37 comments. r/personalfinance · how bad is a credit score? Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually. A credit score is a good credit score. The good-credit range includes scores of to , while an excellent credit score is to A CIBIL Score for a personal loan is a 3-digit number ranging from to that speaks for the credit history of the customer. At SMFG India Credit, the. A FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. If your credit score is , the majority of lenders will accept you for a personal loan. Your interest rate, however, can be slightly higher. A good credit score is usually between to If your credit score is between to it's likely to be considered very good. Calculate loan amounts and mortgage payments for two scenarios; one FICO, myFICO, Score Watch, The score lenders use, and The Score That Matters. A good credit personal loan is potentially available to a borrower with a FICO score of to (scores above are considered very good or excellent). A. Is It Worth Taking Out a Personal Loan to Pay Off Credit Card Debt? 92 upvotes · 37 comments. r/personalfinance · how bad is a credit score? Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually. A credit score is a good credit score. The good-credit range includes scores of to , while an excellent credit score is to A CIBIL Score for a personal loan is a 3-digit number ranging from to that speaks for the credit history of the customer. At SMFG India Credit, the. A FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. If your credit score is , the majority of lenders will accept you for a personal loan. Your interest rate, however, can be slightly higher. A good credit score is usually between to If your credit score is between to it's likely to be considered very good. Calculate loan amounts and mortgage payments for two scenarios; one FICO, myFICO, Score Watch, The score lenders use, and The Score That Matters. A good credit personal loan is potentially available to a borrower with a FICO score of to (scores above are considered very good or excellent). A.

A FICO score will give you access to a variety of credit products, including credit cards, home loans, auto loans, and personal loans, though not. For the most part, the minimum credit score needed for a personal loan approval will depend on the lender. Some lenders will tell you upfront what their minimum. If you have a low score, it can indicate to a lender that you could be more likely to pay late or default on a loan. Conversely, the better your score, the. A credit score is a good credit score. The good-credit range includes scores of to , while an excellent credit score is to The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare. The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare. In other words, "good" means something slightly different for each of the major credit scores. But in general, a score that's at least or above is. Credit Score Personal Loans · Credit Score Personal Loans · Credit Score Personal Loans · Credit Score Personal Loans · Credit Score Personal. My Credit Score · Overdraft Protection · Surcharge-Free ATMs · Reorder Checks · Lost Login. VCCU Online. Accounts · Personal Checking · Compare. Lenders set their own minimum credit scores for personal loans. · In general, a score of and up will entitle you to the best interest rates and other terms. A credit score of is considered excellent and indicates to lenders that you are highly likely to repay your debts responsibly. As a result, lenders are more. Good credit is generally defined as having a credit score of to with FICO or to with VantageScore. Any scores above that may be labeled as. In fact, a credit score is very close to the average credit scores of those in the United States. You can easily receive any type of loan for a cheap price. Not sure where you stand with your credit report? We'll review your credit report with you, and recommend steps to improve or maintain your credit score. To qualify for a lender's best rates, however, you generally need a score of at least The average APR for a three-year personal loan for borrowers with. Lenders generally view those with credit scores of and up as acceptable or lower-risk borrowers. to Fair Credit Score Individuals in this category. Credit scores are three-digit numbers designed to represent the likelihood of paying your bills on time. · Credit scores help lenders decide whether to grant you. For example, you can have a FICO score at TransUnion while scoring just at Experian. Your DTI ratio compares how much debt you have to how much. For personal loans, an ideal credit score is or higher. You can pretty much get any loan you want with that score as long as you aren't over. A personal loan (signature loan) allows you to borrow up to $15, for up to 36 months with no collateral required. These loans are ideal for when you need.

Amortization Rates Calculator

This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Annual fixed interest rate for this mortgage. Monthly payment. Monthly principal and interest payment (PI). Your monthly payment is calculated by taking your current loan amount, mortgage term in years, interest rate per year and the state you reside in and inputting. How to calculate amortization · Step 1: Convert the annual interest rate to a monthly rate by dividing it by · Step 2: Multiply the loan amount by the monthly. Use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan. Our amortization schedule calculator will show your payment breakdown of interest vs. principal paid and your loan balance over the life of your loan. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Annual fixed interest rate for this mortgage. Monthly payment. Monthly principal and interest payment (PI). Your monthly payment is calculated by taking your current loan amount, mortgage term in years, interest rate per year and the state you reside in and inputting. How to calculate amortization · Step 1: Convert the annual interest rate to a monthly rate by dividing it by · Step 2: Multiply the loan amount by the monthly. Use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan. Our amortization schedule calculator will show your payment breakdown of interest vs. principal paid and your loan balance over the life of your loan. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan.

Next, input your down payment size, loan term and expected interest rate. The mortgage amortization calculator can display the composition of your loan's. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. Amortization schedules use columns and rows to illustrate payment requirements over the entire life of a loan. Looking at the table allows borrowers to see. Or, enter in the loan amount and we will calculate your monthly payment! Balloon Loan Calculator, A balloon loan can be an excellent option for many borrowers. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans, and bonds. Mortgage amortization has to do with the gradual increase over time of your monthly payment that goes towards the loan principal rather than the interest. For. This is our basic monthly mortgage payment calculator with an amortization table included. It will quickly estimate the monthly payment based on the home price. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. This calculator will calculate an uknown payment amount, loan amount, rate, or term. What is an amortization schedule? An amortization schedule is the loan. Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly payment. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Amortization Calculator Logo. Car & Mortgage Loan Payment Amortization Table rates are published in a table below the calculator. Calculator 15 Yr Rates. Your amortization summary. Monthly Payment. $1, /mo. Total Interest Paid. $, Total Over Simply enter in the loan amount to calculate monthly payments, along with your principal balances by payment, total of all payments made and total interest. An amortization calculator helps you understand how fixed mortgage payments work. It shows how much of each payment reduces your loan balance and how much. Amortization months. Help. Interest Rate. About. Or input payment. and. For illustrative purposes only. Rates are compounded monthly. CLOSE this window. This calculator will compute a loan's payment amount at various payment intervals — based on the principal amount borrowed, the length of the loan and the. Or, enter the loan amount and the tool will calculate your monthly payment. You can then examine your principal balances by payment, total of all payments made. *This table depicts loan amortization for a $, fixed-rate, year mortgage. The payment calculations above do not include property taxes, homeowners.