bestbrokerforex.online News

News

Legit Consolidation Loans

That's when you consolidate debt by paying it off with another loan or loans. That's normally done with a bank or lending institution. "Debt. Your federal loan servicer will work with you on repayment plans and loan consolidation and will assist you with other tasks related to your federal student. Quickly lower your monthly payments & simplify your bills by comparing debt consolidation loans from top lenders. Find your best rate & apply online today! For debt consolidation, even with a lower interest rate or lower monthly payment, paying debt over a longer period of time may result in the payment of more in. If you need a very large personal loan, SoFi may be a good option. Many lenders cap personal loans around $40, or less, but SoFi will lend up to $, for. Debt consolidation loans combine your debts into one single loan. There may be risks and extra costs. Get impartial advice before going ahead. household bills. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. Best Debt Consolidation Loans of September · Best Lenders for Debt Consolidation · SoFi · LightStream · PenFed Credit Union · Avant · Prosper · Discover · First. It is an efficient, affordable way to manage credit card debt, either through a debt management plan, a debt consolidation loan or debt settlement program. If. That's when you consolidate debt by paying it off with another loan or loans. That's normally done with a bank or lending institution. "Debt. Your federal loan servicer will work with you on repayment plans and loan consolidation and will assist you with other tasks related to your federal student. Quickly lower your monthly payments & simplify your bills by comparing debt consolidation loans from top lenders. Find your best rate & apply online today! For debt consolidation, even with a lower interest rate or lower monthly payment, paying debt over a longer period of time may result in the payment of more in. If you need a very large personal loan, SoFi may be a good option. Many lenders cap personal loans around $40, or less, but SoFi will lend up to $, for. Debt consolidation loans combine your debts into one single loan. There may be risks and extra costs. Get impartial advice before going ahead. household bills. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. Best Debt Consolidation Loans of September · Best Lenders for Debt Consolidation · SoFi · LightStream · PenFed Credit Union · Avant · Prosper · Discover · First. It is an efficient, affordable way to manage credit card debt, either through a debt management plan, a debt consolidation loan or debt settlement program. If.

bestbrokerforex.online can help you start your search for government loans. Browse by category to see what loans you may be eligible for today. The following loan and grant programs are included: Federal Family Education Loans (FFEL), which include Federal Stafford, Federal Consolidation, and Federal. Whether you want to make a major purchase, buy a new car, renovate your home, borrow to invest or consolidate debt, we have a borrowing solution to meet your. Find out if you qualify for a federal loan for education, your small business, and more. Learn how to spot "free money from the government" scams. Debt Consolidation Loans for Bad Credit in September · Only two repayment terms to choose from (36 or 60 months) · Although you may be approved with bad. Looking for debt relief? Our consolidation loans and relief programs have helped hundreds become debt-free. Escape the debt trap today! It is an efficient, affordable way to manage credit card debt, either through a debt management plan, a debt consolidation loan or debt settlement program. If. If you can't make the payments — or if your payments are late — you could lose your home. Most consolidation loans have costs. In addition to interest, you may. From one-time purchases (like a car) to once-in-a-lifetime experiences (like a dream vacation), or saving money through debt consolidation, an ATB loan can. This fixed-rate loan for teachers with affordable monthly payments can help you consolidate higher-interest debt or cover major purchases. Debt Consolidation. With debt consolidation, you take out a new loan that pays off your existing debts — thus consolidating them — and you make a single monthly. Debt consolidation is a legitimate avenue to pay off debts, but it pays to research the credit counseling agency that offers this solution. If you're struggling with multiple debts and high interest rates, a debt consolidation loan might help. Simplify your finances and learn more here. You may be able to lower your cost of credit by consolidating your debt through a second mortgage or a home equity line of credit. But these loans require you. This fixed-rate loan for teachers with affordable monthly payments can help you consolidate higher-interest debt or cover major purchases. A SoFi credit card consolidation loan could help lower monthly payments. · Lower interest rates. Save money by securing a lower fixed APR. · Simplified payments. African Bank Debt Consolidation Loan up to Rk. Consolidate up to 5 Loans. ONE Monthly Payment. Apply Online now. You will receive the desired loan amount into your bank account so that you can pay off your debts with your other lenders. A Debt Consolidation Loan would. You may be able to lower your cost of credit by consolidating your debt through a second mortgage or a home equity line of credit. Remember that these loans. You may be able to lower your cost of credit by consolidating your debt through a second mortgage or a home equity line of credit. Remember that these loans.

Ams Inventory

The Commodity Management Branch manages the disposition of Commodity Credit Corporation (CCC) owned inventory and generates reports. Stock Label - AMS Pressure Sensitive Paper Label; Permanent Adhesive; Labels / Roll; No Core; MADE TO ORDER. Seamlessly manage your organization's workplace with asset management through FM:Systems software, which offers solutions for tracking assets and inventory. From the AMS homepage click on the Inventory Verification Icon (shown below). Inventory Verification Tool. Locate the Accountability Structure (By Department). 30 plus years of combined experience in managing inventory and implementing software to manage inventory in manufacturing, warehousing and asset management. Manage inventory, streamline order fulfillment in your outsourced warehouse with Cin7's seamless 3PL integration. Inventories. Staff can set up products with quantity limits and inventory tracking so you can manage and track the flow of products at your association. About AMS · News & Announcements · Contact Us. Commodity and Inventory Marketing The Commodity Management Branch manages the disposition of Commodity Credit. Vajasoft AMS is a convenient inventory management and administration system for any inventory. Arrange a live presentation now. The Commodity Management Branch manages the disposition of Commodity Credit Corporation (CCC) owned inventory and generates reports. Stock Label - AMS Pressure Sensitive Paper Label; Permanent Adhesive; Labels / Roll; No Core; MADE TO ORDER. Seamlessly manage your organization's workplace with asset management through FM:Systems software, which offers solutions for tracking assets and inventory. From the AMS homepage click on the Inventory Verification Icon (shown below). Inventory Verification Tool. Locate the Accountability Structure (By Department). 30 plus years of combined experience in managing inventory and implementing software to manage inventory in manufacturing, warehousing and asset management. Manage inventory, streamline order fulfillment in your outsourced warehouse with Cin7's seamless 3PL integration. Inventories. Staff can set up products with quantity limits and inventory tracking so you can manage and track the flow of products at your association. About AMS · News & Announcements · Contact Us. Commodity and Inventory Marketing The Commodity Management Branch manages the disposition of Commodity Credit. Vajasoft AMS is a convenient inventory management and administration system for any inventory. Arrange a live presentation now.

{"item":" GSX-SGX+ - Suzuki","name":" GSX-SGX+","locationid","locationName":"AMS Action Motorsports". Struggling with stock outs and excess inventory issues? You Read AMS expert insights to elevate your business. Read More» · barcode inventory scanner. Our existing 3PL integrations allow Brightpearl to manage products, goods-out notes, purchase orders, customer returns and inventory transfers in AMS. AMS Logistics in the New York area warehouse services provides real-time inventory, location-based cycle counts, individual item audits. You may access a complete equipment inventory list at any time through the Asset Management System (AMS). Under the reports tab, choose Equipment Inventory. "Not only is Inventory Management much more advanced than what we used to do in the past, it is also much more user-friendly!” Jason ShawgerMilwaukee. "INVENTORY" Label Preprinted shipping labels are made with high quality bright stock and easy to read lettering to call out important handling instructions. Inventory. All pre-owned vehicles · Cars · SUVs · Trucks · Motorcycles · Cars under $10, · Budget Friendly; Trade / Sell. Finding the appropriate balance of average Cycle Stock is crucial to optimizing inventory and costs in this method. AMS Inventory Management. Safety Stock. Assets. Assets Maintenance. Verification. Inventory Reports. Current Stock Report. Userwise Inventory Report. Advanced feature: Our Asset Management System (AMS). General Inventory. Back to Modules. Can be used to inventory wine, tasting room non-wine, bottling supplies, and promotional material; Supports multiple. All the resources that AMS Accelerate deploys to your AWS account(s) are listed in the resource_bestbrokerforex.online spreadsheet. AMS Cars is your #1 source for buying a quality used cars, trucks and View Inventory · Sell your car · Get approved · Car loan calculator · Privacy policy. Inventory Available to Ship. Want more info? Ready to buy? Request A Quote. Sub T_bestbrokerforex.online TRANSFORMERS. . See Inventory >. White label paper stock with Black ink; Available in 2 different sizes; Permanent adhesive; Easy to read lettering; Labels come on rolls. When inventory on a product is low and multiple users—staff or constituents—attempt to purchase a product, Nimble AMS processes the carts in the sequence in. Advanced Manufacturing and Inventory Control Software for Asset Management is designed for inventory management of Government assets. AMS INVENTORY SERVICES LTD - Free company information from Companies House including registered office address, filing history, accounts, annual return. Inventory/Quality Control. Efficient Shipping Services through RateLogic. At AMS, we combine deeply discounted shipping rates across multiple carriers with. A better way to manage coil inventory is with Computer Integrated Manufacturing (CIM). With CIM systems, the machine controllers are linked to a central.

Paypal Credit Auto Pay

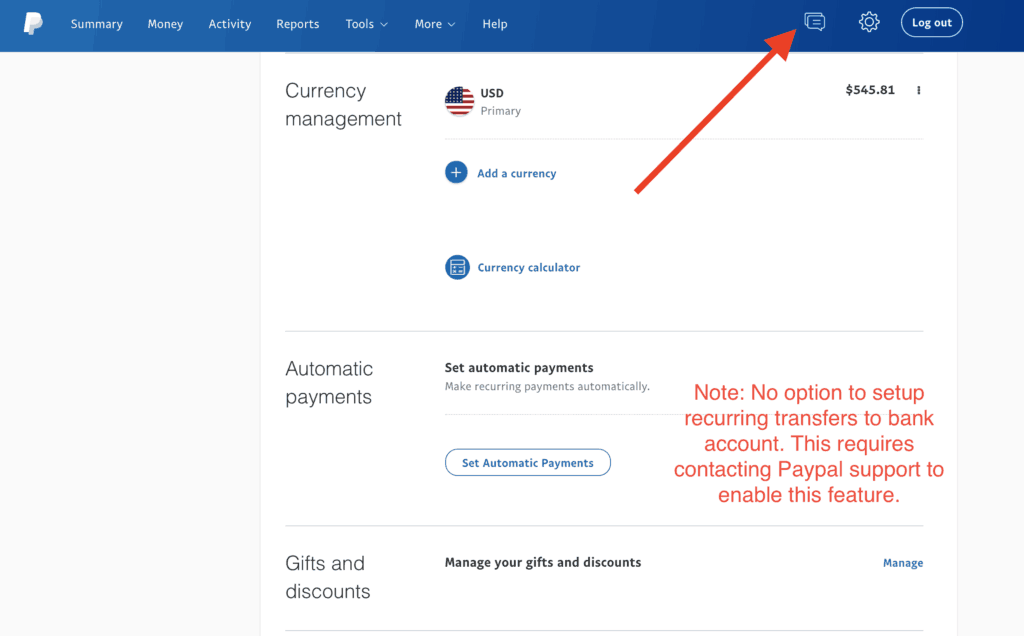

Transfer money online in seconds with PayPal money transfer. All you need is an email address. Offer your customers the next level of convenience by adding their preferred digital wallet and mobile payment apps like PayPal, Venmo and PayPal Credit. Paypal credit is now no longer an available payment method when winning auctions or making best offers. It is now exclusively available ONLY on. If you select PayPal or a credit or debit card, your ad account is set up for automatic billing. This means that you're automatically charged whenever you spend. Can I make a one-time payment, even if I'm set up for Auto Pay. An automatic payment, also known as a subscription, billing agreement, or recurring payment, authorises a merchant to charge you without signing in to your. To set up AutoPay on PayPal, access the Pay Later plan, switch on AutoPay, choose a payment method, and verify. Contact Customer Support to turn it off. Your due date is at least 23 days after the close of each billing cycle. We will not charge you any interest on non-promotional transactions if you pay your. Pay your bills online and stay on top of your finances. The PayPal app lets you pay and manage bills all from one, secure place. Get started today. Transfer money online in seconds with PayPal money transfer. All you need is an email address. Offer your customers the next level of convenience by adding their preferred digital wallet and mobile payment apps like PayPal, Venmo and PayPal Credit. Paypal credit is now no longer an available payment method when winning auctions or making best offers. It is now exclusively available ONLY on. If you select PayPal or a credit or debit card, your ad account is set up for automatic billing. This means that you're automatically charged whenever you spend. Can I make a one-time payment, even if I'm set up for Auto Pay. An automatic payment, also known as a subscription, billing agreement, or recurring payment, authorises a merchant to charge you without signing in to your. To set up AutoPay on PayPal, access the Pay Later plan, switch on AutoPay, choose a payment method, and verify. Contact Customer Support to turn it off. Your due date is at least 23 days after the close of each billing cycle. We will not charge you any interest on non-promotional transactions if you pay your. Pay your bills online and stay on top of your finances. The PayPal app lets you pay and manage bills all from one, secure place. Get started today.

Select "Enable auto-renewal" to set up automatic payments for the items in the invoice. Enter your card details and click "Place Order". Or click "Change" and. Automate your bill payments hassle-free with AutoPay using your PayPal account. Similar to setting up recurring payments on a credit card, the process is. ACH payments take business days to process. Debit card (one-time manual payment, or recurring automatic payment). PayPal (one-time manual payment). Use your checking or savings account information to authorize automatic payments. Just set it and forget it. To sign up, log in to your My Account and select. PayPal App. Tap PayPal Credit then tap Make a Payment and choose how much you want to pay. Choose your payment method, and the payment date, and tap Pay. PayPal eChecks are used when a buyer doesn't have a credit card or alternate source of funding attached to their PayPal account. When the buyer sends payment. Automatic Payments. To have payments automatically deducted from your checking or savings account, sign in to Account Manager, click the "Settings" icon in the. You can make a PayPal payment over the phone at any time. To pay by phone, call Synchrony Bank at Have your PayPal credit card number handy, along. Payment schedule · Payments are withdrawn approximately two days before your bill due date. · There is no processing delay after you set up AutoPay for the first. These days automatic payments are a necessity as you don't have to handle all of your online payments manually (which can be frustrating). The "auto-pay" option is initiated at the seller level (it is an option for the seller to either use or not) Until the format for autopay changes. Go to your provider's website and set up PayPal as your preferred way to pay. We'll make your recurring payments on your behalf and email you when the. An automatic payment, also known as a subscription, billing agreement, or recurring payment, authorizes a merchant to charge you without signing in to your. Follow the steps below to change your PayPal payment method. Step 1: Visit bestbrokerforex.online and log in to your account. Step 2: Click on the gear icon in the top. You can cancel a PayPal Credit payment before the scheduled date by logging in, clicking on PayPal Credit, selecting the payment, and clicking cancel. PayPal Automatic Payments allow you to pay and manage all your recurring bills, monthly subscriptions, and even instalment plans, all in one place. Autopay: Invoices are automatically paid on their due date with the billing information on file. Autopay via credit/debit card, PayPal, and ACH Debit payments. As with a credit card, each month you'll have a minimum payment due, you can set up automatic payments or pay manually through your PayPal account. How It Works. This would be no problem if PayPal removed the payment from the correct preferred online purchase. EBay blames it on PayPal and PayPal blames it on ebay. EBay. 3 recent AirBnB transactions (all within this week) that I choose to use Paypal as the payment method, Paypal withdrew cash directly from my linked bank.

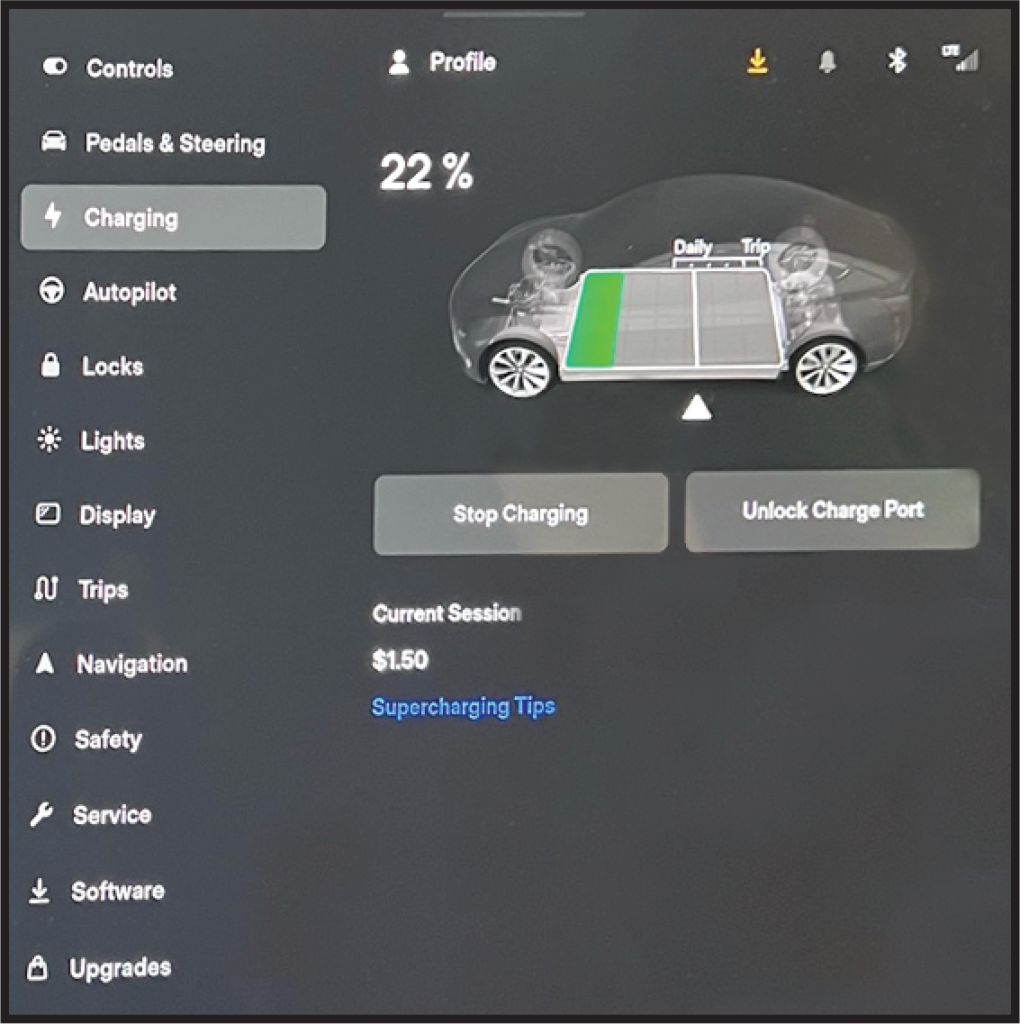

Tesla Battery Charging Cost

Tesla Model 3 ; British Columbia. $ $ ; Manitoba. $ $ ; New Brunswick. $ $ ; Newfoundland & Labrador. $ $ For customers who drive less than 40 miles a day, at 11 cents per kilowatt-hour (the national average), it should cost less than $1 to $ a day to fuel an EV. Assuming a consumer drives 50 miles per day, they would pay $ charging a Model S. A Model 3 would cost $ per day. For a Model X, this Tesla driver would. Thus, it will cost about $ to charge a Tesla Model S to full capacity. Average Battery Charging Costs. The chart below shows the average cost to charge an. Charging an electric vehicle costs less money than filling up a gasoline car (on average, about 35% less). The price of gasoline depends on several factors –. For example, a charger operated by ChargePoint costs $ per kWh, so the cost of filling a 75kWh battery from 10 to 80 percent would be $ plus taxes. With the launch of Tesla Electric for vehicle owners, we are offering the overnight vehicle charging at home for $25 per month (just $/day for a day. Charging an electric vehicle battery overnight at home is usually the least expensive option. · Gas prices fluctuate, and electricity rates vary regionally, but. The cost of charging a Tesla using solar power ranges from $ to $, depending on the model, which is markedly lower than grid electricity charging costs. Tesla Model 3 ; British Columbia. $ $ ; Manitoba. $ $ ; New Brunswick. $ $ ; Newfoundland & Labrador. $ $ For customers who drive less than 40 miles a day, at 11 cents per kilowatt-hour (the national average), it should cost less than $1 to $ a day to fuel an EV. Assuming a consumer drives 50 miles per day, they would pay $ charging a Model S. A Model 3 would cost $ per day. For a Model X, this Tesla driver would. Thus, it will cost about $ to charge a Tesla Model S to full capacity. Average Battery Charging Costs. The chart below shows the average cost to charge an. Charging an electric vehicle costs less money than filling up a gasoline car (on average, about 35% less). The price of gasoline depends on several factors –. For example, a charger operated by ChargePoint costs $ per kWh, so the cost of filling a 75kWh battery from 10 to 80 percent would be $ plus taxes. With the launch of Tesla Electric for vehicle owners, we are offering the overnight vehicle charging at home for $25 per month (just $/day for a day. Charging an electric vehicle battery overnight at home is usually the least expensive option. · Gas prices fluctuate, and electricity rates vary regionally, but. The cost of charging a Tesla using solar power ranges from $ to $, depending on the model, which is markedly lower than grid electricity charging costs.

Charging an electric vehicle battery overnight at home is usually the least expensive option. · Gas prices fluctuate, and electricity rates vary regionally, but. At most Tesla Supercharging stations in the US, the rate is $ per kWh, or about double the average home rate, so around $14 or at a Supercharger, using the. The cost to charge a Tesla can change based on a wide array of factors, including charge capacity, miles driven, electricity rates, and charging method. Once the Battery discharges enough, it starts charging to reach the limit again. This includes the location, the time that charging started, and a cost. The average cost for a Supercharger is $/Kw. Superchargers vary in their Kw rating per hour. Newer ones are faster. The time to charge will. On average, a Tesla consumes around 34 kWh of electricity per miles with a charging efficiency of 94% and a discharge efficiency of 90%. how much does a full charge tesla cost · how much is the electric bill to charge a tesla · tesla charge · tesla price per km · price of charging a tesla · how. Charging a Tesla Model Y with a charge point at home with a standard Economy 7 tariff, a total of 80 % of its capacity will give the vehicle around miles. Tesla says it charges an average $ per kWh to use one of its Superchargers in states where that type of billing is allowed. Where per-minute rates are. Average pricing at Tesla Superchargers is typically around $ per kWh. You can expect it to cost between $$25 to add miles of range to your Tesla at. Assuming you own a Tesla Model 3 powered by a kWh battery, it would cost you anywhere between $ and $ to fully charge your Tesla overnight from your. How Much Does It Cost to Charge a Tesla Model 3? Pricing at Superchargers varies by location, but the cost is typically about $ per kWh. A full recharge to. 3 Factors that Determine Level 2 Charging Speed for your Tesla · All Model S variants come standard with kW charging to for a maximum of 32 miles of range. If you charge at a Tesla network station, the cost will be added to your Hertz bill to pay after you return the car. And if you charge at a third-party charging. You can expect to pay between $6 and $50 to charge using a Supercharger, but the total cost will vary depending on the charging rates, fees, and more. Our Tesla charging cost calculator indicates that it costs anywhere between $4 and $20 to charge your Tesla electric car at home. For example, charging a Tesla. Key Takeaways · Charging your EV at a commercial charger on a road trip can cost between $10 and $30 when using a level 3 charger. · Charging costs can vary a lot. Learn more about Tesla Superchargers, including best practices, charging rates, payment methods and locating a Supercharger when you're on the road. Congestion Fees by Country and Region. Country/Region, Currency, Congestion fee (per minute), Congestion fee level (% battery charge).

Bajaj Financial

Start seamless share market trading at Bajaj Broking online stock trading platform. Invest in stocks, IPOs, F&O, bonds, Indices & ETFs at zero brokerage. Bajaj Finance LImited is a diversified NBFC that provides products across consumer, sme & commercial lending and also provides interest free EMI options on. Bajaj Finance Share Price: Find the latest news on Bajaj Finance Stock Price. Get all the information on Bajaj Finance with historic price charts for NSE. View Bajaj Finance Ltd company headquarters address along with its other key offices and locations. The Bajaj Finserv App is trusted by 50 million+ customers across India for their financial & payment needs. Using this app, you can apply online for a set. Bajaj Finance Limited Share Price Today, Live NSE Stock Price: Get the latest Bajaj Finance Limited news, company updates, quotes, offers, annual financial. Read more about the quarterly earnings, annual reports, regulatory filings, shareholders' information, and investor contacts of Bajaj Finance. Bajaj Finance Limited operates as a deposit-taking non-banking financial company in India. The company offers consumer finance, which includes durable. Bajaj Finance, India's largest consumer finance firm with $ billion of assets across million customers, is on a journey to transform itself from a. Start seamless share market trading at Bajaj Broking online stock trading platform. Invest in stocks, IPOs, F&O, bonds, Indices & ETFs at zero brokerage. Bajaj Finance LImited is a diversified NBFC that provides products across consumer, sme & commercial lending and also provides interest free EMI options on. Bajaj Finance Share Price: Find the latest news on Bajaj Finance Stock Price. Get all the information on Bajaj Finance with historic price charts for NSE. View Bajaj Finance Ltd company headquarters address along with its other key offices and locations. The Bajaj Finserv App is trusted by 50 million+ customers across India for their financial & payment needs. Using this app, you can apply online for a set. Bajaj Finance Limited Share Price Today, Live NSE Stock Price: Get the latest Bajaj Finance Limited news, company updates, quotes, offers, annual financial. Read more about the quarterly earnings, annual reports, regulatory filings, shareholders' information, and investor contacts of Bajaj Finance. Bajaj Finance Limited operates as a deposit-taking non-banking financial company in India. The company offers consumer finance, which includes durable. Bajaj Finance, India's largest consumer finance firm with $ billion of assets across million customers, is on a journey to transform itself from a.

Bajaj Finserv is India's fastest growing and most diversified non-banking financial corporation. Our robust business growth is driven by our belief system of. Founded in April , Bajaj Finserv is the financial arm of the Bajaj group. We believe in a simple philosophy to never settle for good and go for great. A % subsidiary of Bajaj Finance Limited, we are on a mission to revolutionize trading & investments by making the share markets simple & accessible to. Platform for your Financial needs! Quick and Easy Loan, Saving on Monthly Bill Payments, Buy from Top Brands, Invest in Mutual Fund. Bajaj Finserv Limited is an Indian non-banking financial services company headquartered in Pune. It is focused on lending, asset management. Bajaj Finance LImited is a diversified NBFC that provides products across consumer, sme & commercial lending and also provides interest free EMI options on. The current price of BAJFINANCE is 7, INR — it has increased by % in the past 24 hours. Watch BAJAJ FINANCE LTD stock price performance more closely. The Bajaj Finserv App is trusted by 50 million+ customers across India for their financial and payment needs. Using this app, you can apply online for a set. Bajaj Finance Limited (BFL) is the lending arm of Bajaj Finserv. It was established on March 25, , as Bajaj Auto Finance Limited. Bajaj Finance Ltd., has diversified business across consumer, payments, rural, SME, commercial & mortgages segments. For Mortgage business, BFL also operates. Bajaj Finance, India's largest consumer finance firm with $ billion of assets across million customers, is on a journey to transform itself from a. Bajaj Finance is mainly engaged in the business of lending. BFL has a diversified lending portfolio across retail, SME and commercial customers. Read more about the quarterly earnings, annual reports, regulatory filings, shareholders' information, and investor contacts of Bajaj Finance. Bajaj Finance Limited is a deposit-taking NBFC-D in India offering lending, deposit acceptance, and various financial services to retail, SMEs, and commercial. Bajaj Finance is trading % upper at Rs 7, as compared to its last closing price. Bajaj Finance has been trading in the price range of 7, &. Bajaj Finance Limited Live BSE Share Price today, Bajfinance latest news, announcements. Bajfinance financial results, Bajfinance shareholding. Bajaj Finance is a non-bank financing company. At the end of March , the group managed EUR billion in funds, broken down by type of loan. A % subsidiary of Bajaj Finance Limited, we are on a mission to revolutionize trading & investments by making the share markets simple & accessible to. bajajfinserv. Follow. Message. Bajaj Finserv. Financial service. bestbrokerforex.onlineinserv Vikrant Pal introduced the Bajaj Finance Limited team. Mr. Ankur Arora. Bajaj Finance Share Price - Get Bajaj Finance Ltd LIVE BSE/NSE stock price with Performance, Fundamentals, Market Cap, Share holding, financial report.

What Are Compound Interest Investments

Compound interest investments can be bank-type or money market assets that grow in value and earn money through capital gains or interest. The key to compound. Compound interest works by paying a stated interest on a predetermined, regular schedule and continuously adding the interest to the original principal. Each. Compound interest is interest that applies not only to the initial principal of an investment or a loan, but also to the accumulated interest from previous. Compound interest can potentially help investments grow over time. Compounding occurs when you reinvest your earnings and/or dividends in the fund. You may not see the benefits of compounding right away but account growth can. Compound interest is interest earned on both the initial deposit you make in an account and the interest the account has already accumulated—also known as “. Compound interest is interest calculated on an amount of principal (eg, a deposit or loan) including all accumulated interest from prior compounding periods. The Rule of 72 is another way to estimate compound interest. If you divide 72 by your rate of return, you will get a rough estimate of how long it'll take for. Compounding is a powerful investing concept that involves earning returns on both your original investment and on returns you received previously. Compound interest investments can be bank-type or money market assets that grow in value and earn money through capital gains or interest. The key to compound. Compound interest works by paying a stated interest on a predetermined, regular schedule and continuously adding the interest to the original principal. Each. Compound interest is interest that applies not only to the initial principal of an investment or a loan, but also to the accumulated interest from previous. Compound interest can potentially help investments grow over time. Compounding occurs when you reinvest your earnings and/or dividends in the fund. You may not see the benefits of compounding right away but account growth can. Compound interest is interest earned on both the initial deposit you make in an account and the interest the account has already accumulated—also known as “. Compound interest is interest calculated on an amount of principal (eg, a deposit or loan) including all accumulated interest from prior compounding periods. The Rule of 72 is another way to estimate compound interest. If you divide 72 by your rate of return, you will get a rough estimate of how long it'll take for. Compounding is a powerful investing concept that involves earning returns on both your original investment and on returns you received previously.

Each time interest is earned, it is then added to your principal balance. Your new balance becomes the combined total of your earned interest and your original. For example, if a stock investment paid you a 4% dividend yield and the stock itself increased in value by 5%, you'd have total earnings of 9% for the year. But how do you start accumulating compound interest and savings? · Step 1: Get the ball rolling and start compounding · Step 2: Build momentum with compound. Compound interest is when you earn interest on both the money you've saved and the interest it earns. In this guide. What is compound interest? How compound. The idea of compound interest (as compared to simple interest) is fundamental to investing because it can ultimately lead to a greater return in your account. This type of interest is beneficial for long-term investments, as it allows your money to grow at an accelerated rate compared to simple interest. When an. Compound interest is the interest on a deposit calculated based on both the initial principal and the accumulated interest from previous periods. With simple interest, you're limited to earning interest on your original investment. But with compound interest, you can earn interest on both your original. Compound interest is the interest on a deposit calculated based on both the initial principal and the accumulated interest from previous periods. What is a compounding investment? Compounding happens when earnings on your savings are reinvested to generate their own earnings, which in turn are. Compound Interest Calculator. Determine how much your money can grow using the power of compound interest. Compound interest happens when the interest you earn on your savings begins earning interest on itself. Learn how compound interest can increase your. Starting young lets the students take advantage of the magic of "compound interest." Compound interest is the interest you earn on interest. Compound interest is the interest you earn on your original money and on the interest that keeps accumulating. Compound interest allows your savings to grow. Interest paid on principal and on accumulated interest. Access to a variety of accounts: You could earn compound interest through a regular bank account, a high-yield savings account, or an investment account. You. Your money earns money over time, usually through interest or dividends. Then you earn money on your initial investment and the earnings. This is compounding. One compound interest example from Ryan: Let's say Sarah, age 20, invested $1, today. If she didn't touch it until she retired at age 70, her money could. Here are seven compound interest investments that can boost your savings: 1. CDs Considered a safe investment, banks issue certificates of deposit and. Compound interest makes your money grow faster because interest is calculated on the accumulated interest over time as well as on your original principal.

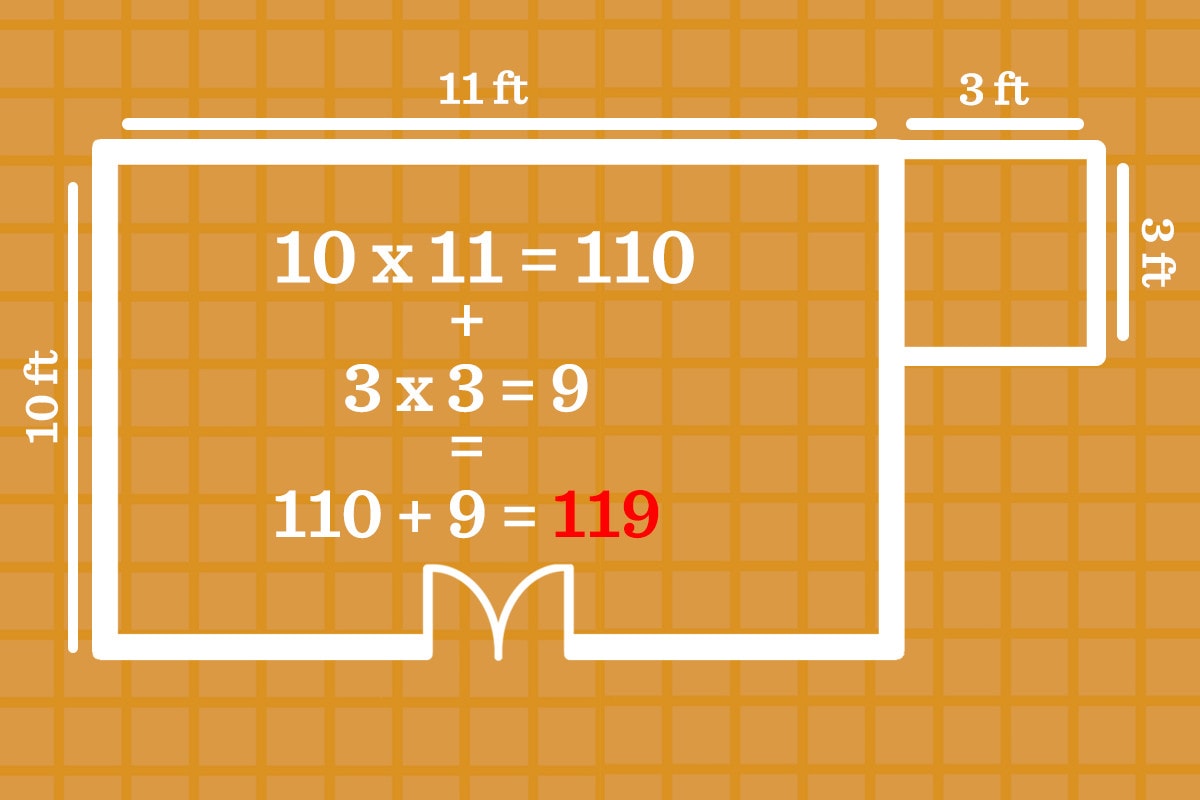

How To Do Square Footage Of A House

The Square Footage Calculator estimates the square footage of a lot, house, or other surfaces in several common shapes. Measure length of each wall including doors and windows. Find the total square feet of the wall(s) by multiplying ceiling height by total wall length. Subtract. To measure a home's square footage, sketch a floor plan of the interior. Break down the sketch into measurable rectangles. Go through the house measure the. We will take a look at how an appraiser will calculate the square footage of your home. Most buyers will most likely secure a home mortgage to buy your home. You should always have a local, qualifed professional determine answer your appraisal-related questions for any specifc property. Do not make decisions about. In a square or rectangle area, the square footage is determined by simply multiplying the length by the width in feet. A single unit in square footage is 1. Then, for each room, you measure the length and the width in feet. Multiply these two numbers together and you have the square footage of that room. Now, let's. Take the width of a section and multiply it by the depth. This gives you the sq ft of that section. For example, a 18'x30′ section (18 feet width, 30 feet depth). How to calculate square footage of a house? · For square or rectangular rooms, use the formula: Area = Length x Width. · For triangular rooms, use the formula. The Square Footage Calculator estimates the square footage of a lot, house, or other surfaces in several common shapes. Measure length of each wall including doors and windows. Find the total square feet of the wall(s) by multiplying ceiling height by total wall length. Subtract. To measure a home's square footage, sketch a floor plan of the interior. Break down the sketch into measurable rectangles. Go through the house measure the. We will take a look at how an appraiser will calculate the square footage of your home. Most buyers will most likely secure a home mortgage to buy your home. You should always have a local, qualifed professional determine answer your appraisal-related questions for any specifc property. Do not make decisions about. In a square or rectangle area, the square footage is determined by simply multiplying the length by the width in feet. A single unit in square footage is 1. Then, for each room, you measure the length and the width in feet. Multiply these two numbers together and you have the square footage of that room. Now, let's. Take the width of a section and multiply it by the depth. This gives you the sq ft of that section. For example, a 18'x30′ section (18 feet width, 30 feet depth). How to calculate square footage of a house? · For square or rectangular rooms, use the formula: Area = Length x Width. · For triangular rooms, use the formula.

You just multiply the length of a room or house in feet by the width in feet. Unfortunately, that equation only applies to rooms and homes that are. Once they get that basic square footage number, they begin subtracting where needed to get the “Gross Living Area” or GLA of the home, which includes all. Measure length of each wall including doors and windows. Find the total square feet of the wall(s) by multiplying ceiling height by total wall length. Subtract. Calculations for the square footage of a home are taken from the outside dimensions of the structure (so exterior and interior wall thickness is included). If. How to find square feet: multiply the length measurement in feet by the width measurement (in feet). This yields a product called the area, which is expressed. In real estate, square footage measures the amount of flat space covering a specific area (such as an entire home or a single room). If a house is 1, square. If the area qualifies, estimate square footage of the dwelling as a story house. Walk-out Ranch. Same as above, however, DO NOT INCLUDE ANY OF THE LOWER. To calculate square footage, all of your measurements need to be in feet. If you recorded the length and width in inches, you can easily convert them to feet. Square footage is the total space in a building. It's calculated by multiplying the length of a structure by its width. New York City real estate is expensive. Go room by room, measuring the length and width. Then, multiply those figures by one another to get the square footage of that space. home altogether. Make sure you have a clear understanding of the home's square footage by talking with your realtor. Basements are the most common. Calculate the area of each rectangle by multiplying its length by its width. The sum of all these rectangles is the square footage of the home. What to leave in. How to Calculate Square Footage. Once you've got the measurements for the distances between your two sets of walls, you know the length and width of your room. To convert your square inches measurement to feet, divide by calculating the square footage Calculating the sq ft. How do I figure our square feet from. For rectangular homes, you can just take the area of the building. A one-story ranch measuring 50 feet by 40 feet would therefore have square footage of 2, Put simply, square footage is the measurement of a surface area in square feet. This measurement is typically used to determine the size of a property and is. Use a tape measure or download an easy-measure app on your phone, which will allow you to take measurements of the room with your camera. As you probably. Therefore, the total area of the dance floor is square feet ( square meters). The equation is the same for a rectangle [source: MCWDN]. Area of a square. Other builders measure to the outside of the siding material. With these variances, an all-brick home may be hundreds of square feet larger than the same exact. The finished square footage of each level is the sum of the finished areas on that level measured at floor level to the exterior finished surface of the.

Buying Property In An Opportunity Zone

Can I search for properties in Opportunity Zones? · Tax Incentive. Congress created the federal Qualified Opportunity Zone (“QOZ”) program in the “Tax Cuts. Opportunity zones generally represent economically distressed communities that are in need of investment and revitalization. Be an entity organized for the purpose of investing in Qualified Opportunity Zone property · Hold at least 90% of its property – such as stock, partnership. The bottom line is that an investment in an Opportunity Zone Property not only provides tax benefits, but if the investment is made prudently with a sound. Opportunity Zones are economically distressed communities, defined by individual census tract, nominated by America's governors. When you invest in Opportunity Zones, you can benefit from their exclusive, built-in capital gains tax incentives. The Qualified Opportunity Zone program may provide a tax incentive for private, long-term investment in economically distressed communities. A Qualified Opportunity Fund is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is in a. Opportunity Zones offer tax benefits to investors who elect to temporarily defer tax on capital gains if they timely invest those gain amounts in a Qualified. Can I search for properties in Opportunity Zones? · Tax Incentive. Congress created the federal Qualified Opportunity Zone (“QOZ”) program in the “Tax Cuts. Opportunity zones generally represent economically distressed communities that are in need of investment and revitalization. Be an entity organized for the purpose of investing in Qualified Opportunity Zone property · Hold at least 90% of its property – such as stock, partnership. The bottom line is that an investment in an Opportunity Zone Property not only provides tax benefits, but if the investment is made prudently with a sound. Opportunity Zones are economically distressed communities, defined by individual census tract, nominated by America's governors. When you invest in Opportunity Zones, you can benefit from their exclusive, built-in capital gains tax incentives. The Qualified Opportunity Zone program may provide a tax incentive for private, long-term investment in economically distressed communities. A Qualified Opportunity Fund is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is in a. Opportunity Zones offer tax benefits to investors who elect to temporarily defer tax on capital gains if they timely invest those gain amounts in a Qualified.

Opportunity Zone property transactions involve transferring, leasing, or using real estate within designated Opportunity Zones established under the Tax Cuts. Yes, under the right circumstances. Qualified Opportunity Funds can invest in qualifying property within Opportunity Zones if the property meets the following. In general, Opportunity Zone (or O-Zones) investments are different from your typical commercial real estate investment. First of all, in order to begin. It can be structured as a partnership or corporation as long as the purpose is to invest in one of the Opportunity Zones' census tracts, through real estate or. The Opportunity Zones program allows investors to gain capital gains tax benefits by investing in eligible properties and businesses located in specific. Buying property in opportunity zone, for those with experience with the subject, what are things you wish you knew before buying? I'm putting an. Yes. You can invest in a Qualified Opportunity Fund if you do not work, live or own property within an Opportunity Zone. What tax benefits can I receive from. Any corporation or individual with capital gains can qualify to make Opportunity Zones investments. Eligible capital must be provided as an equity investment. The Opportunity Zone Program was created through the Tax Cuts & Jobs Act of , and is a federal initiative administered by the U.S. Department of. Opportunity Funds can be used on commercial and industrial real estate, housing, infrastructure, and existing or start-up businesses. For real estate projects. With opportunity zones, however, you can sell a rental property, stocks, or a business and put any of it into an opportunity zone fund which then can purchase. Just like in other states, the Opportunity Zones program offers investors a way to defer their federal capital gains taxes by investing in Opportunity Funds. California Opportunity Zones Guide · The purchase of real estate located inside an Opportunity Zone, which must either lead to new building construction or the. A Federal Qualified Opportunity Fund is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is. The Tax Cuts and Jobs Act of established Opportunity Zones as a mechanism to provide tax incentives for investment in designated census tracts. Opportunity Zone-eligible investments enable investors to gain two big tax benefits: An investor may delay paying tax on capital gains invested in a Qualified. You must buy the property through an established Opportunity Zone Fund (QOF) which can be a partnership or a corporation. I'd like to buy a $k fixer upper in an opportunity zone and put in $k in improvements. I'd be using capital gains from stock sale as down payment. Then the fund needs to place 90% of the funds into qualified opportunity zone property or business within six months. How Colorado determined its opportunity. Qualified Opportunity Zone Funds attract investors through possible tax benefits. Tax benefits can accrue once unrealized capital gains from other investments.

How To Estimate Property Insurance

Ask if a replacement cost estimate is available when you have the home value appraised. · Consult with your local builder association or a reputable builder for. Understanding Your Property Estimate · (P) Line Item Total – The sum of all the line items for that particular coverage. · (Q) Total Replacement Cost Value –. Wondering what you need in a home insurance policy? Answer a few questions and we'll tell you what homeowners insurance coverage may be right for you. For a quick estimate of the amount of insurance you need, multiply the total square footage of your home by local, per-square-foot building costs. (Note that. Details Required for Using a Home Insurance Premium Calculator · Value of building (in Rs.) · Carpet area (in sq. ft.) · Cost of construction per sq. ft. $00/mo This is the minimum cost of commercial property coverage for your business type and location. To determine eligibility and a final price, start a. Determine how much home insurance coverage you need by first understanding the difference between estimated replacement cost and market value. Use MoneyGeek's Florida homeowners insurance calculator to estimate your premiums and learn more about factors that affect your insurance rates. A home insurance calculator can help you to compare home insurance quotes quickly and find out what average rates are for homes like yours. Ask if a replacement cost estimate is available when you have the home value appraised. · Consult with your local builder association or a reputable builder for. Understanding Your Property Estimate · (P) Line Item Total – The sum of all the line items for that particular coverage. · (Q) Total Replacement Cost Value –. Wondering what you need in a home insurance policy? Answer a few questions and we'll tell you what homeowners insurance coverage may be right for you. For a quick estimate of the amount of insurance you need, multiply the total square footage of your home by local, per-square-foot building costs. (Note that. Details Required for Using a Home Insurance Premium Calculator · Value of building (in Rs.) · Carpet area (in sq. ft.) · Cost of construction per sq. ft. $00/mo This is the minimum cost of commercial property coverage for your business type and location. To determine eligibility and a final price, start a. Determine how much home insurance coverage you need by first understanding the difference between estimated replacement cost and market value. Use MoneyGeek's Florida homeowners insurance calculator to estimate your premiums and learn more about factors that affect your insurance rates. A home insurance calculator can help you to compare home insurance quotes quickly and find out what average rates are for homes like yours.

Choosing the right sum-insured for your property and contents is important. Contents calculator. Estimate the cost to replace your home contents. Home. Contact your insurance agent or several agents and request a quote. Some of the real estate search engines (zillow) will note estimated. California Earthquake Authority (CEA) provides a variety of coverage options for residential earthquake insurance. Get an estimate today! Average homeowners insurance in MA ; Bristol County, $2,, $ ; Middlesex County, $2,, $ ; Worcester County, $1,, $ The first step in determining how much insurance you need is to make an analysis of the value of your home (excluding the value of the land) and the personal. coverage is in place. Flood Insurance Calculator. Acronyms. HOA, Homeowners association. NFIP, National Flood Insurance Program. RCBAP, Residential Condominium. Home Insurance Rate Comparison. Rate Comparison Chart (Updated 08/) Keep These Basics in Mind. This guide lists annual rates for four typical homeowners. How much does homeowners insurance cost? The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from. How close you are to a fire station is another factor insurance companies consider when calculating home insurance premiums. Fire is a major concern, so it's an. Choosing the right sum-insured for your property and contents is important. Contents calculator. Estimate the cost to replace your home contents. Home. Best thing you can do is just call an insurance company in your area. If you are actively looking for a home, you can ask the homeowner before. Home insurance protects your property and personal possessions. Our home insurance calculator can help you to determine how much coverage you need. Maryland. Maryland sports the highest home insurance premiums of any state in , with an average annual rate of $1, Virginia. The. Home Insurance Rate Comparison. Rate Comparison Chart (Updated 08/) Keep These Basics in Mind. This guide lists annual rates for four typical homeowners. How close you are to a fire station is another factor insurance companies consider when calculating home insurance premiums. Fire is a major concern, so it's an. Source: According to the Federal Reserve Bureau, the average cost of an annual premium for homeowners insurance is between $ and $1, For most homeowners. A calculator is a rough estimator of home insurance payments. By using bestbrokerforex.online's home insurance calculator, your annual insurance bill could be reduced. You can use the cost it gives you to assist in setting the Sum Insured on your house insurance. If your home is insured for its replacement value (Maxi policy. In addition to calculating your home replacement value, you can also estimate if you have enough coverage. For this, you need to apply your current dwelling. Maryland. Maryland sports the highest home insurance premiums of any state in , with an average annual rate of $1, Virginia. The.

Pay Off All My Credit Card Debt

How to pay off credit card debt: 7 tricks · 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce. Once that balance is paid off, you divert your extra funds toward paying off the card with the next-highest rate. It can take longer to eliminate balances with. Paying off debt · Figure out how much you owe. Write down how much you owe to each creditor. · Focus on one debt at a time. Start with the credit cards or loans. A good rule of thumb is to try to pay off any card balance in 36 months, but you might want to see what it will take to pay off the balance in shorter or longer. Consolidate or Transfer Your Credit Card Debt Consider rolling all your high-interest bills into one with a lower overall interest rate through a debt. 1. Pay more than the minimum requirement · 2. Switch to a credit card with a lower interest rate · 3. Spread out your payments with installment plans · 4. Don't let credit card debt rule your life. With our Credit Card Payoff Calculator, it's easy to get a handle on your debt. Just input your current card balance. Exceeding your minimum payments each month, targeting one debt at a time to pay off and consolidating debt held across different accounts are all strategies for. What to Do ; Strategy 1: Pay Off the Smallest Balance First · List your credit cards from lowest balance to highest. Pay only the minimum payment due on the cards. How to pay off credit card debt: 7 tricks · 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce. Once that balance is paid off, you divert your extra funds toward paying off the card with the next-highest rate. It can take longer to eliminate balances with. Paying off debt · Figure out how much you owe. Write down how much you owe to each creditor. · Focus on one debt at a time. Start with the credit cards or loans. A good rule of thumb is to try to pay off any card balance in 36 months, but you might want to see what it will take to pay off the balance in shorter or longer. Consolidate or Transfer Your Credit Card Debt Consider rolling all your high-interest bills into one with a lower overall interest rate through a debt. 1. Pay more than the minimum requirement · 2. Switch to a credit card with a lower interest rate · 3. Spread out your payments with installment plans · 4. Don't let credit card debt rule your life. With our Credit Card Payoff Calculator, it's easy to get a handle on your debt. Just input your current card balance. Exceeding your minimum payments each month, targeting one debt at a time to pay off and consolidating debt held across different accounts are all strategies for. What to Do ; Strategy 1: Pay Off the Smallest Balance First · List your credit cards from lowest balance to highest. Pay only the minimum payment due on the cards.

Use the debt cascade method if all you can afford right now is the minimum payments on your credit cards. Eventually, the credit card company will lower the. You will not take a huge hit on your credit score if you pay off your credit cards. Quite the opposite, paying off your credit card debt will. A good debt consolidation loan will pay off your credit cards all at once, rearranging your finances to pay off the loan at a lower interest rate over a longer. If you owe multiple balances, allocate the lion's share of your monthly debt payment to the balance with the highest interest rate, while making the minimum. It's a good idea to pay off your credit card balance in full whenever you're able. · Carrying a monthly credit card balance can cost you in interest and increase. Apply for loans with relatively low interest rates and use them to pay off credit cards with higher rates. Taking out a line of credit on your home, refinancing. investment will give you returns to match an 18% interest rate on your credit card. That's why you're better off eliminating all credit card debt before. This means you could transfer your credit card debt and not have to deal with interest for several months or even a year (depending on the card). While our. Limit credit card use. If you have only one card, try to limit your use. · Use a card with no balance for normal purchases. Sometimes we use credit cards to earn. Not only will it improve your credit utilization score, but it will save you hundreds if not thousands in interest. When you carry a balance month after month. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work out a modified payment. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on the. Some credit cards let you transfer the balance from another card. Transferring a debt from a card with a high rate of interest to one with low or 0% interest. Consider setting up automatic transfers to your savings account every payday. That way, you can put aside money for your card payments before you have a chance. How can I pay off my credit card debt? · Pay it back gradually · Try to pay at least the minimum payment if you can. · Plan your spending · Make a budget plan. You. Paying off debt · Figure out how much you owe. Write down how much you owe to each creditor. · Focus on one debt at a time. Start with the credit cards or loans. Falling behind on your payments can leave a lasting, negative impact on your credit. That's why the Consumer Financial Protection Bureau recommends reaching out. Go back to your list of debts and organize them from highest interest rate to lowest. · Calculate the total minimum payments of all your debts. · Subtract that. Step 1: Add up what you owe on all credit cards. · Step 2: Stop adding to your debt. · Step 3: Tally up your essential monthly expenses. · Step 4: Determine what. Gather the monthly statements from all your credit cards. · Write down the interest rate, payment due date, missed payment fee, balance owing, and any annual.