bestbrokerforex.online Recently Added

Recently Added

Best Stock Trend Indicators

:max_bytes(150000):strip_icc()/dotdash_v2_Trend_Trading_The_4_Most_Common_Indicators_Aug_2020-04-6987288ca87845a38aa041c607412379.jpg)

For technical analysis, many traders prefer using Moving Averages (MA) to identify trends, RSI to gauge overbought or oversold conditions, and. It doesn't matter whether you're trading stocks, commodities, futures or any other market; technical indicators are a common theme. great price action trader. Trend indicators measure trend direction. Moving averages, Directional Movement and MACD are three of the most popular trend indicators. The best investors in the history of stock investment have relied on technical indicators chart pattern to try to predict the market trend. Indicators. ADX is an indicator used to gauge the strength of the underlying trend in the market. Traders use ADX to filter out the best trending and ranging markets to. Determination of the moving average on the chart is effortless, when the price trend of the chart stays about the MA, the stock is in an uptrend, whereas, if. 10 common trading indicators you can use · 1. Simple Moving Average (SMA) · 2. Exponential Moving Average (EMA) · 3. Moving Average Convergence Divergence (MACD). Trend analysis is arguably the most important area of technical analysis and is key to determining the overall direction of a security. The best technical indicators for day trading are the RSI, Williams Percent Range, and MACD. These measurements show overbought and oversold levels on a chart. For technical analysis, many traders prefer using Moving Averages (MA) to identify trends, RSI to gauge overbought or oversold conditions, and. It doesn't matter whether you're trading stocks, commodities, futures or any other market; technical indicators are a common theme. great price action trader. Trend indicators measure trend direction. Moving averages, Directional Movement and MACD are three of the most popular trend indicators. The best investors in the history of stock investment have relied on technical indicators chart pattern to try to predict the market trend. Indicators. ADX is an indicator used to gauge the strength of the underlying trend in the market. Traders use ADX to filter out the best trending and ranging markets to. Determination of the moving average on the chart is effortless, when the price trend of the chart stays about the MA, the stock is in an uptrend, whereas, if. 10 common trading indicators you can use · 1. Simple Moving Average (SMA) · 2. Exponential Moving Average (EMA) · 3. Moving Average Convergence Divergence (MACD). Trend analysis is arguably the most important area of technical analysis and is key to determining the overall direction of a security. The best technical indicators for day trading are the RSI, Williams Percent Range, and MACD. These measurements show overbought and oversold levels on a chart.

Trend trading relies on key technical indicators to gauge the strength, persistence and likely continuation of any trend that an investor intends to trade on. Stock indicators are tools that help traders identify future movements of the price of particular shares. They include moving averages, Bollinger bands, the. Indicators like the MACD or RSI are often used to identify divergences. Trend Strength Trading Strategies. Trend strength trading strategies focus on trading in. Furthermore, there are five main types of trading indicators: Trend Following, Momentum, Volatility, Support/Resistance, and Volume. They are grouped based on. For technical analysis, many traders prefer using Moving Averages (MA) to identify trends, RSI to gauge overbought or oversold conditions, and. Technical indicators highlight a particular aspect of price or volume behavior on a stock chart to provide valuable insights and help with analysis. This guide details the top 52 trading indicators in trading, explaining their uses and highlighting their importance in strategy development and risk. Trading View is great for all the indicators on offers. Sharing three valuable stock market indicators to define the strength of the trend. The MACD indicator can be used to identify and confirm trends, time turning points, and gauge momentum. It often foretells a change in the strength, direction. For stocks that regularly cross 70 and 30, traders have used 80 and 20 as the benchmarks. However, in most cases, 70 and 30 remain the benchmark. Chart patterns. The following indicators are regarded as the best trend indicators: · 1. The Bollinger Band Indicator · 2. The Moving Average Convergence Divergence Indicator. We'll examine some of the best technical indicators utilised by traders worldwide, and their definitions so you can take advantage of these techniques. Momentum indicators measure the strength of a stock's price movement in one direction over a given time period and work best in conjunction with trend-following. The 9 Best Technical Indicators for the Stock Market · On Balance Volume · Accumulation/Distribution Line · Average Directional Index · The Aroon Indicator. The ADX is an indicator that you could use to determine the direction of the trend and for the strength as well. The ADX indicator comes with three lines: the. The MACD indicator can be used to identify and confirm trends, time turning points, and gauge momentum. It often foretells a change in the strength, direction. Trend traders use technical indicators to identify a trend and take advantage of trading opportunities before it reverses. Moving average lines such as, simple, exponential, weighted and volume-weighted show the trend in the stock price or market index movement. The. Leading indicators are indicators able to precede the price movements of a currency/stock due to their predictive qualities. Trend analysis is arguably the most important area of technical analysis and is key to determining the overall direction of a security.

Lost Retirement Accounts

You can go to the Abandoned Plan database, hosted by the Department of Labor. There you can search the company, and you will be provided with information on how. Unclaimed retirement accounts from discontinued plans · Unclaimed accounts lost contact with the owners. The Department is responsible for. SECURE will establish a new searchable database on the Department of Labor website to look for lost retirement savings accounts. Is it better for you to consolidate your retirement savings into one plan so you have fewer accounts to track? Job loss - Important information workers. For information on unclaimed retirement account balances. Internal Revenue Service (IRS) For information on unclaimed tax refunds. Federal Deposit Insurance. A national database to find forgotten (k)s and pensions could be on the way, but savers should take action now to locate any missing retirement accounts. For information on unclaimed retirement account balances. Internal Revenue Service (IRS) For information on unclaimed tax refunds. Federal Deposit Insurance. for retirement accounts to get lost in the shuffle.2 Think back to your first job. Can you remember what happened to your work-sponsored retirement plan? If. Start by scouring your personal email or laptop for any old (k) plan statements that you may have saved in the past. You can go to the Abandoned Plan database, hosted by the Department of Labor. There you can search the company, and you will be provided with information on how. Unclaimed retirement accounts from discontinued plans · Unclaimed accounts lost contact with the owners. The Department is responsible for. SECURE will establish a new searchable database on the Department of Labor website to look for lost retirement savings accounts. Is it better for you to consolidate your retirement savings into one plan so you have fewer accounts to track? Job loss - Important information workers. For information on unclaimed retirement account balances. Internal Revenue Service (IRS) For information on unclaimed tax refunds. Federal Deposit Insurance. A national database to find forgotten (k)s and pensions could be on the way, but savers should take action now to locate any missing retirement accounts. For information on unclaimed retirement account balances. Internal Revenue Service (IRS) For information on unclaimed tax refunds. Federal Deposit Insurance. for retirement accounts to get lost in the shuffle.2 Think back to your first job. Can you remember what happened to your work-sponsored retirement plan? If. Start by scouring your personal email or laptop for any old (k) plan statements that you may have saved in the past.

WI Lost and Found: Claiming Behavior in Abandoned Retirement Accounts. Researchers. Anita Mukherjee · Corina Mommaerts. Abstract. Many tax-advantaged. When it's time to retire, hopefully you'll have money in at least one retirement savings account. But you may have retirement savings you've forgotten. The majority of unclaimed money comes from brokerage, checking and savings accounts, along with annuities, (k)s and Individual Retirement Accounts. The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of. It may seem obvious, but one of the quickest ways to track down an old (k) plan is to go directly to the source. This database includes missing participants who earned benefits in several types of retirement plans: Defined benefit pension plans that ended in a standard. Susan Diehl ERISA plans have a procedure that is typically followed by financial institutions if a participant is “lost.” But what do you do in a non-ERISA. The IRS will no longer process requests to locate retirement plan participants or beneficiaries. In the absence of IRS letter forwarding services, sponsors. One of the best ways to find lost retirement accounts is to contact your former employers. If you're unsure where to direct your call, try the human resources. Don't cash out your retirement savings upon losing your job. Instead, roll it over into an IRA or a new employer's retirement savings plan to continue. Liz Farmer spoke to NAUPA Legal Committee chair and Illinois Chief of Staff G. Allen Mayer, Esq. about lost (k) accounts, ERISA issues, and the efficacy of. If the DOL can't point you in the right direction, you may have to try unclaimed funds portals. When money is left in a (k) for an extended period after. Retirement Benefits · Special Financial Assistance - Multiemployer Plans · Cybersecurity · Missing Participants account pension plans that have been abandoned. As employers have shifted from defined benefit pensions to individualized retirement plans such as (k)s, workers have become responsible for tracking. They should be able to provide you with your old retirement investment account information to track down your lost funds. 3. Search public databases. With some. The Employee Benefits Security Administration of the Department of Labor has advisors available to help with retirement issues. You can call or. Do you have a long-lost retirement account left with a former employer? Maybe it's been so long that you can't even remember. With over 24 million “forgotten”. Unclaimed retirement funds might be slipping through the cracks when individuals neglect to monitor their accounts or fall below the minimum balance. When employees retire or switch jobs, they sometimes leave their retirement funds behind in the former employer's plan. IRA or a Missing Participant IRA. Websites to Check · National Registry of Unclaimed Retirement Benefits – This database uses employer and Department of Labor data to determine if you have any.

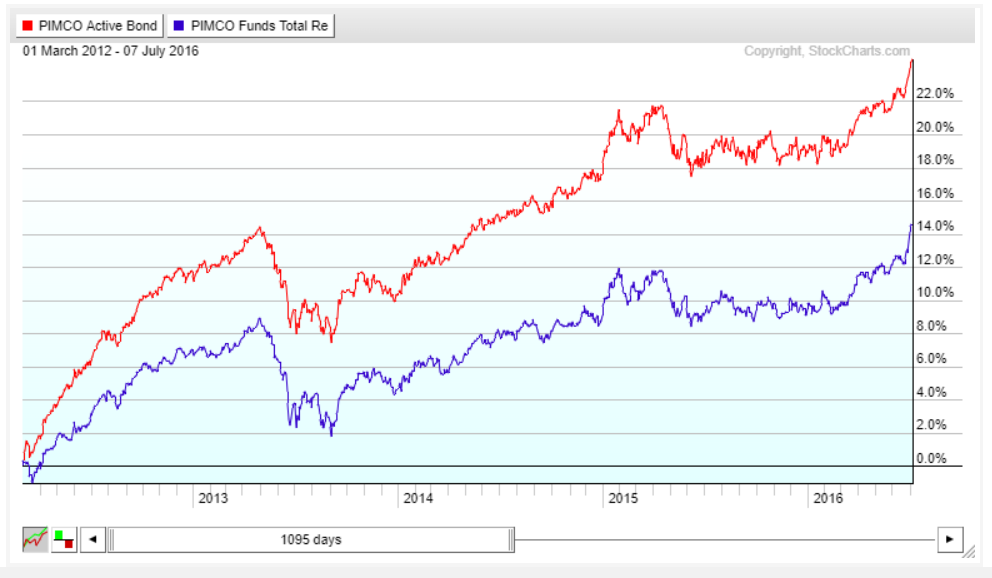

Pimco Active Bond Fund

The Fund seeks maximum total return. The Fund invests at least 65% of its total assets in a diversified portfolio of Fixed Income Instruments of varying. Performance charts for PIMCO Active Bond Exchange-Traded Fund (08PL - Type ETF) including intraday, historical and comparison charts, technical analysis and. The Fund invests at least 80% of its assets in a diversified portfolio of Fixed Income Instruments of varying maturities. The Fund may invest up to 30% of its. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for PIMCO Active Bond Exchange-Traded Fund (BOND). Gain valuable insights from. The fund normally invests at least 80% of its assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by. PIMCO BOND ETF (PIMCO Active Bond Exchange-Traded Fund): stock price, performance, provider, sustainability, sectors, trading info. It invests primarily in investment grade debt securities, but may invest up to 30% of its total assets in high yield securities, as rated by Moody's, S&P or. The net returns of All Active Bond. Funds, All Active Equity Funds and PIMCO Bond Funds Passive peers are mutual funds and ETFs classified as an “index fund”. BOND is designed to provide core fixed income exposure, and seeks to achieve attractive risk-adjusted income while preserving purchasing power through active. The Fund seeks maximum total return. The Fund invests at least 65% of its total assets in a diversified portfolio of Fixed Income Instruments of varying. Performance charts for PIMCO Active Bond Exchange-Traded Fund (08PL - Type ETF) including intraday, historical and comparison charts, technical analysis and. The Fund invests at least 80% of its assets in a diversified portfolio of Fixed Income Instruments of varying maturities. The Fund may invest up to 30% of its. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for PIMCO Active Bond Exchange-Traded Fund (BOND). Gain valuable insights from. The fund normally invests at least 80% of its assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by. PIMCO BOND ETF (PIMCO Active Bond Exchange-Traded Fund): stock price, performance, provider, sustainability, sectors, trading info. It invests primarily in investment grade debt securities, but may invest up to 30% of its total assets in high yield securities, as rated by Moody's, S&P or. The net returns of All Active Bond. Funds, All Active Equity Funds and PIMCO Bond Funds Passive peers are mutual funds and ETFs classified as an “index fund”. BOND is designed to provide core fixed income exposure, and seeks to achieve attractive risk-adjusted income while preserving purchasing power through active.

BOND ETF in-depth analysis and real-time data such as the investment strategy, characteristics, ETF Facts, price, exposure, AuM, Expense Ratio, and more. Basic Stats. The share price of PIMCO ETF Trust - PIMCO Active Bond Exchange-Traded Fund as of August 9, is $ / share. This is a decrease of %. Get the latest PIMCO Active Bond ETF (BOND) fund price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Real time Pimco ETF Trust - Pimco Active Bond Exchange-Traded Fund (BOND) stock price quote, stock graph, news & analysis. PIMCO Enhanced Short Maturity Active ESG Exchange-Traded Fund (EMNT) is an actively managed exchange-traded fund (ETF) that seeks maximum current income. BOND Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. BOND's dividend yield, history, payout ratio & much more! bestbrokerforex.online: The #1 Source For Dividend Investing. Get PIMCO Active Bond Exchange-Traded Fund (BOND:NYSE) real-time stock quotes, news, price and financial information from CNBC. When fixed income securities join or leave an index, their prices tend to rise or fall as passive investors rush to buy or sell. Active investors seek to. About PIMCO Active Bond Exchange-Traded Fund Exchange-Traded Fund BOND is designed to provide core fixed income exposure, and seeks to achieve attractive risk. Investors who want to outperform bond indices use actively managed investment strategies. Active portfolio managers can attempt to maximize income or capital . PIMCO Bond ETFs are funds that track various fixed-income sectors and segments of the global bond market. The bonds can be of various duration lengths. The Fund may invest up to 15% of its total assets in securities and instruments that are economically tied to emerging market countries. The Fund will normally. The PIMCO Active Bond Exchange-Traded Fund (USD) is a(n) Fixed Income Exchange Traded Funds (ETF) seeks to invest in Investment Grade sector located in. A high-level overview of PIMCO Active Bond Exchange-Traded Fund ETF (BOND) stock. Stay up to date on the latest stock price, chart, news, analysis. This ETF offers a way for investors to access one of the most successful bond fund managers of all time, as BOND (formerly known as TRXT) is essentially an. PIMCO ETF List ; PIMCO Year US TIPS Index ETF · STPZ, Short-Term Inflation-Protected Bond ; PIMCO Active Bond ETF · BOND, Intermediate. PIMCO Active Bond ETF has securities in its portfolio. The top 10 holdings constitute % of the ETF's assets. The ETF meets the SEC requirement of being. What Is the PIMCO Active Bond Ticker Symbol? BOND is the ticker symbol of the PIMCO Active Bond ETF. What Is the BOND Stock Price Today? The BOND stock price. The fund normally invests at least 80% of its assets in a diversified portfolio of Fixed Income. Instruments of varying maturities, which may be represented by.

How To Find Out My Apr For A Car

Use Bank of America's auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan. Auto Loan Interest Rate Calculator. header image. Estimate Your Auto Loan Interest Rate. Follow the steps below and click calculate. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. The interest rate on your car loan is largely determined by your credit score. Sam Leman Automotive Group discusses average auto loan rates for the full. If your auto loan application is approved, your interest rate is locked in Hit the water for the weekend or find your home at sea. Up to year. Use this helpful car payment calculator to determine what your monthly auto loan payment will be, and let us help you secure a loan with great rates for. Use this calculator to find the APR (annual percentage rate) and true cost of any loan by entering its interest rate, finance charges and term. Average interest rate for a car loan ; Super prime (), %, % ; Prime (), %, % ; Nonprime (), %, % ; Subprime (). So, to figure out how to calculate the interest rate on a car, follow these simple steps: Principal Amount x Interest Rate x Time (in years) = Total Interest. Use Bank of America's auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan. Auto Loan Interest Rate Calculator. header image. Estimate Your Auto Loan Interest Rate. Follow the steps below and click calculate. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. The interest rate on your car loan is largely determined by your credit score. Sam Leman Automotive Group discusses average auto loan rates for the full. If your auto loan application is approved, your interest rate is locked in Hit the water for the weekend or find your home at sea. Up to year. Use this helpful car payment calculator to determine what your monthly auto loan payment will be, and let us help you secure a loan with great rates for. Use this calculator to find the APR (annual percentage rate) and true cost of any loan by entering its interest rate, finance charges and term. Average interest rate for a car loan ; Super prime (), %, % ; Prime (), %, % ; Nonprime (), %, % ; Subprime (). So, to figure out how to calculate the interest rate on a car, follow these simple steps: Principal Amount x Interest Rate x Time (in years) = Total Interest.

Just ask the lender what the APR is. I believe laws dictate that they must provide this information on the final documents, at least in US. Also. APR stands for annual percentage rate, and it refers to the cost of your loan, which includes the interest rate and additional fees. The APR of your car loan is. Estimate your monthly payments with bestbrokerforex.online's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. The Annual Percentage Rate, or APR, is the total amount of interest paid on the financing of a vehicle, over the term of one year. Your APR is the true cost of borrowing. How to determine your APR on a car loan. Prequalification is an excellent way to find out if you're able to get a. Use Carvana's auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments. Learn what your APR encompasses, how to calculate your APR, what counts as a “good” APR, plus get answers to your other APR FAQs. This auto loan tool takes into account your credit score, current interest rates, and the term length of the loan to determine how much you'll pay per month. We use your amount financed, APR and the length of your contract to calculate your monthly payment. Your next vehicle is waiting for you. Find a dealer and get. interest rate, the APR actually considers the total finance charge you pay on your loan, including prepaid finance charges such as loan fees and the interest. If only the monthly payment for any auto loan is given, use the Monthly Payments tab (reverse auto loan) to calculate the actual vehicle purchase price and. To calculate the car payment for your auto loan, consider using a car loan calculator that can factor in loan amount, interest rate, annual percentage rate. Our calculator can help you estimate your monthly auto loan payment, based on loan amount, interest rate and loan term. It'll also help you figure out how much. Calculate monthly auto payments. Use our financing payment calculator to estimate your monthly payment for a new or used vehicle you buy at a dealership. be a more informed car shopper if you know the factors that can affect the interest rate on your car loan. We've listed some of the most important ones below. First, add interest charges and fees,. This formula is a lot to digest and can help you understand how APR is calculated. Fortunately, the Truth in Lending Act. One way to lower the interest rate on a car loan is to compare rates and payments terms from different sources to know all your options. Be sure to ask your. Use this car payment calculator to check what your monthly payment might be if you finance a car. Simply enter the loan amount, interest rate and term. Typically, you can find your credit card APR near the end of your monthly statement. There will be a section of the statement marked "Interest Charge. However, you'll be paying more in interest over the life of your loan. Car loan interest rate. The interest rate for car loans is also called the annual.

Six Month Cd Calculator

Note down the total interest earned upon maturity and then sum them up. Consider this CD ladder example: 75% APY for a 6-month CD. 80% APY for a 1-year CD. month CD, and so on. At the end of two years you'll have four, month CDs with a CD maturing every six months. Total to invest. This is the total amount to. Best 6-month CD rates · Best 1-year CD rates · Best 5-year CD rates. Get guidance. CD calculator · CD ladder calculator · CD rate trends · CD resources · CD. Whether you choose to save for six months, five years, or somewhere in between, this calculator can tell you precisely how much interest you'll earn and how. Use First State Bank's Certificate of Deposit Calculator to find out how much interest you can earn on a CD based on different rates. Learn more online. However, the same CD that compounds every month would earn $ Can you get 6% on a CD? Banks make their interest income from the difference between the. Certificates of Deposits (CDs) are a great way to reach your savings goals on a set schedule. Use this calculator to find out how much interest you can earn. 6-month term as of August 30, Open in minutes. %. APY with a month How do we determine this calculation? ×. pop-up window. This example is. To see what your estimated earning potential is for different variations, just plug in a deposit amount and term into the CD calculator. Note down the total interest earned upon maturity and then sum them up. Consider this CD ladder example: 75% APY for a 6-month CD. 80% APY for a 1-year CD. month CD, and so on. At the end of two years you'll have four, month CDs with a CD maturing every six months. Total to invest. This is the total amount to. Best 6-month CD rates · Best 1-year CD rates · Best 5-year CD rates. Get guidance. CD calculator · CD ladder calculator · CD rate trends · CD resources · CD. Whether you choose to save for six months, five years, or somewhere in between, this calculator can tell you precisely how much interest you'll earn and how. Use First State Bank's Certificate of Deposit Calculator to find out how much interest you can earn on a CD based on different rates. Learn more online. However, the same CD that compounds every month would earn $ Can you get 6% on a CD? Banks make their interest income from the difference between the. Certificates of Deposits (CDs) are a great way to reach your savings goals on a set schedule. Use this calculator to find out how much interest you can earn. 6-month term as of August 30, Open in minutes. %. APY with a month How do we determine this calculation? ×. pop-up window. This example is. To see what your estimated earning potential is for different variations, just plug in a deposit amount and term into the CD calculator.

Open a Standard CD Today! ; 6 months, %, % ; 9 months, %, % ; 12 months, %, % ; 18 months, %, %. CD Laddering Calculator. Examine the benefits of investing At the end of two years you'll have four, month CDs with a CD maturing every six months. 6 Month CD, %, %. 9 Month CD, %, %. 12 Month CD, %, %. 18 CD Calculator. Pick your term and deposit amount and see how your savings. Free calculator to find the total interest, end balance, and the growth chart of a Certificate of Deposit with the option to consider income tax. Open a Certificate of Deposit. With rates above the national average and terms from six months to six years, creating your safety net won't be a stretch. Best 6-month CD rates · Best 1-year CD rates · Best 5-year CD rates. Get guidance. CD calculator · CD ladder calculator · CD rate trends · CD resources · CD. Use the calculator to see how much you can possibly earn with a deposit account at Arsenal. Start a live chat with us to open your account online. For six-month. CD Basics · A Fixed Term: anywhere from a few days to 20 years, most CD terms fall between 6 months and 5 years. · A Higher Interest Rate: the main reason most. Use the calculator to see how much you can possibly earn with a deposit account at Arsenal. Start a live chat with us to open your account online. For six-month. Renews to Month CD. Open an Account. 13 Month CD Special. $1, minimum WaFd CD Savings Calculator. Use the Savings Calculator to see out how. CD Calculator. Certificate of Deposit Calculator. Are you If you don't expect you'll need the cash for at least six months, a CD might be a wise choice. month CD, and so on. At the end of two years you'll have four, month CDs with a CD maturing every six months. Total to invest. This is the total amount to. CD Ladder Calculator. A CD ladder is made up of CDs with staggered maturity Certificates of Deposit. 1-month CDs · 6 month CD · 9-month CDs · 1-year CDs · CD Calculator. HOW MUCH WILL MY CD BE WORTH? certificate of deposit jumbo cd rates. 6-month: % APY* month: % APY* month: % APY. How much interest will you earn on a Certificate of Deposit (CD)? guarantee you a fixed interest rate. compare cd accounts Try our CD calculator. 6-month CD. % apy1. $10, minimum deposit. Apply Now. month CD. Use this CD calculator to find out how much interest you can earn on a Certificate of Deposit, compounded daily, monthly, quarterly, semi-annually. Certificate of Deposit Calculator. All certificates are compounded semi-annually, except 3-month and month certificates. This tool you will take into consideration your initial deposit amount, interest rate, the number of months the CD will be held for, and how often the interest. Months. The term of the CD, expressed in months. Interest rate. The published interest rate for this CD. Make sure to.

Should You Sell Bonds When Interest Rates Rise

Conversely, if interest rates decline, your bond would suddenly look more attractive, and would likely demand a price higher than face value should you to sell. Issuers use the bond's maturity and prevailing market interest rates to determine a competitive interest rate, called the coupon rate. It's expressed as an. Because bond prices typically rise when interest rates fall, the best way to earn a high total return from a bond or bond fund is to buy it when interest rates. Issuers use the bond's maturity and prevailing market interest rates to determine a competitive interest rate, called the coupon rate. It's expressed as an. When interest rates rise, bonds lose value. Interest rate risk is the risk that rates will change before the bond reaches its maturity date. However, avoid. now suppose market interest rates rise from 3% to 4%. If you sell the 3 for investors to consider interest rate risk when they purchase bonds in a. Interest rate risk is the risk that a bond's value will fall as interest rates rise. Bond prices and yields move in opposite directions, so when yields are. As we mentioned above, rising interest rates reduce bond prices, putting a drag on fixed income returns. But there's another, positive effect. Because companies. When interest rates are rising, you can purchase new bonds at higher yields. Over time the portfolio earns more income than it would have if interest rates. Conversely, if interest rates decline, your bond would suddenly look more attractive, and would likely demand a price higher than face value should you to sell. Issuers use the bond's maturity and prevailing market interest rates to determine a competitive interest rate, called the coupon rate. It's expressed as an. Because bond prices typically rise when interest rates fall, the best way to earn a high total return from a bond or bond fund is to buy it when interest rates. Issuers use the bond's maturity and prevailing market interest rates to determine a competitive interest rate, called the coupon rate. It's expressed as an. When interest rates rise, bonds lose value. Interest rate risk is the risk that rates will change before the bond reaches its maturity date. However, avoid. now suppose market interest rates rise from 3% to 4%. If you sell the 3 for investors to consider interest rate risk when they purchase bonds in a. Interest rate risk is the risk that a bond's value will fall as interest rates rise. Bond prices and yields move in opposite directions, so when yields are. As we mentioned above, rising interest rates reduce bond prices, putting a drag on fixed income returns. But there's another, positive effect. Because companies. When interest rates are rising, you can purchase new bonds at higher yields. Over time the portfolio earns more income than it would have if interest rates.

Falling rates would typically cause long-term bond prices to rise. This repricing of bonds is based on the return an investor would receive if they held the. But investors who sell a bond before it matures may get a far different amount. For example, if interest rates have risen since the bond was purchased, the. It's high yield and not high quality that tends to perform better in the bond markets as rates start to rise, says Morgan Stanley's. Richard Lindquist. There. Apart from interest rates, portfolio managers also pay close attention to inflation expectations. Often called the 'enemy of the bond investor', rising. Put simply, when interest rates are rising, new bonds will pay investors higher interest rates than old ones, so old bonds tend to drop in price. Falling. Investors are unlikely to see much price appreciation (in fact, they will likely experience a decrease in value) in a rising-interest-rate environment. In. Because we pay interest on the adjusted principal, the amount of interest payment also varies. You can hold a TIPS until it matures or sell it before it matures. When interest rate falls, the coupon rate (unchanged) exceeds the required return (decreased), then the bond is considered to be a better. Subscribe to investor education and EMMA email updates from the MSRB. BUYING AND SELLING BONDS. Evaluating a Municipal Bond's. Interest Rate Risk. One of the. Once a bond is issued, it offers fixed interest payments to its owner over its term to maturity, which does not change. However, interest rates in financial. If you buy a new issue bond or certificate of deposit (CD) and plan to keep it to maturity, changing prices, market interest rates, and yields typically do. Your bonds become more valuable if interest rates drop, but they become less valuable if interest rates rise. When interest rates go up, it means new bonds will. If interest rates rise quickly, the underlying value of your bonds will drop so substantially that you probably will experience an overall loss. If you sell a bond before its maturity date, you may get more than its face value; you could also receive less if you must sell when bond prices are down. No, one should sell bonds(as they would have appreciated in value when the interest rates fell) and buy equities with cheap money. In a declining interest rate environment, the price of a bond with a call feature may be lower than it would be in a rising interest rate environment because. The relationship between interest rates and bond prices is inversely proportional. When interest rates rise, bond prices fall, and vice versa. This inverse. Because we pay interest on the adjusted principal, the amount of interest payment also varies. You can hold a TIPS until it matures or sell it before it matures. The value of most bonds and bond strategies are impacted by changes in interest rates. interest rates rise, and low interest rate environments increase this. Bonds can be issued by companies or governments and generally pay a stated interest rate. · The market value of a bond changes over time as it becomes more or.

Pwc Stock

This guide explains the fundamental principles of accounting for all types of stock-based compensation, including which arrangements are subject to its scope. U Motors Inc. Usage, New. Stock #, 58B Color, BLACK. Style, PWC. {"item". Invesco Exchange-Traded Fund Trust - Invesco Dynamic Market ETF (NYSEMKT: PWC). $ (%). $ Price as of August 30, , p.m. ET. Jump to. Ticker Symbol: PWC INDEX DESCRIPTION: The Market Intellidex is comprised of US stocks selected each quarter by the American Stock Exchange pursuant to a. Find the latest Invesco Dynamic Market ETF (PWC) stock quote, history, news and other vital information to help you with your stock trading and investing. PWC Capital Inc. (bestbrokerforex.online): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock PWC Capital Inc. | Toronto S.E.: PWC. PricewaterhouseCoopers International Limited is a British multinational professional services brand of firms, operating as partnerships under the PwC brand. Latest PWC (PWC) stock price, holdings, dividend yield, charts and performance. Stock analysis for PricewaterhouseCoopers PAC I (D:US) including stock price, stock chart, company news, key statistics, fundamentals and company. This guide explains the fundamental principles of accounting for all types of stock-based compensation, including which arrangements are subject to its scope. U Motors Inc. Usage, New. Stock #, 58B Color, BLACK. Style, PWC. {"item". Invesco Exchange-Traded Fund Trust - Invesco Dynamic Market ETF (NYSEMKT: PWC). $ (%). $ Price as of August 30, , p.m. ET. Jump to. Ticker Symbol: PWC INDEX DESCRIPTION: The Market Intellidex is comprised of US stocks selected each quarter by the American Stock Exchange pursuant to a. Find the latest Invesco Dynamic Market ETF (PWC) stock quote, history, news and other vital information to help you with your stock trading and investing. PWC Capital Inc. (bestbrokerforex.online): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock PWC Capital Inc. | Toronto S.E.: PWC. PricewaterhouseCoopers International Limited is a British multinational professional services brand of firms, operating as partnerships under the PwC brand. Latest PWC (PWC) stock price, holdings, dividend yield, charts and performance. Stock analysis for PricewaterhouseCoopers PAC I (D:US) including stock price, stock chart, company news, key statistics, fundamentals and company.

This chapter discusses the accounting for preferred stock, including convertible preferred stock. Stock analysis for Pinnacle West Capital Corp (PWC:Frankfurt) including stock price, stock chart, company news, key statistics, fundamentals and company. Stock. Usage, New. Stock #, C. Color, WT1. Style, PWC. Vin, KAWC from. $ / mo. Instant • No credit impact. Get Prequalified. A high-level overview of PWC Capital, Inc. (PWESF) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Companies that become entangled in cheap stock issues risk delays in their IPO or stock listing and may be required to take a cheap stock charge, which is an. Invesco Dynamic Market ETF (PWC): Price and Financial Metrics ETF · Invesco Dynamic Market ETF (PWC): $ · Get Rating · Component Grades. PWC Fund Rankings. The data and information contained herein is not intended to be investment or tax advice. A reference. Pinnacle West Capital shareholders who own DE:PWC stock before this date will receive Pinnacle West Capital's next dividend payment of € per share on Sep View live PINNACLE WEST CAPITAL chart to track its stock's price action. Find market predictions, PWC financials and market news. Should You Buy or Sell (bestbrokerforex.online) Stock? Get The Latest PWC Stock Analysis, Price Target, Dividend Info, and Headlines at MarketBeat. PWC | Complete Pinnacle West Capital Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. PWC Capital Inc (bestbrokerforex.online): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock PWC Capital Inc | Toronto S.E.: PWC | Toronto. Should You Buy or Sell Invesco Bloomberg MVP Multi-factor ETF Stock? Get The Latest PWC Stock Price, Constituents List, Holdings Data, and Headlines at. Find the latest Invesco Dynamic Market ETF (PWC) stock quote, history, news and other vital information to help you with your stock trading and investing. Limited Time Offer! $9, i. Availability, In Stock. Usage. Fundamentals · Market Capitalization, $K 3, · Shares Outstanding, K · Annual Sales, $ 0 K · Annual Income, $ 0 K · Month Beta N/A · Price/Sales N/A. Increase your gift to PWC and your tax deduction with one simple strategy. Make a bigger impact by donating long-term appreciated securities, including publicly. PWC - Invesco Capital Management LLC - Invesco Dynamic Market ETF Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (NYSE). PWC - Invesco Capital Management LLC - Invesco Dynamic Market ETF Stock - Stock Price, Institutional Ownership, Shareholders (NYSE). See the latest Pinnacle West Capital Corp stock price (PWC:XFRA), related news, valuation, dividends and more to help you make your investing decisions.

Fastest Growing Jobs In The Next 10 Years

The BLS predicts that there will be a rise of 68% in wind turbine technicians over the next ten years. Getting into this role requires the right qualifications. The Bureau of Labor Statistics of US has comprised a list of the occupations anticipated to be the fastest growing from through Electrical Engineer, then get a job working in power generation, then pick your next step. You could go back to school for an MBA, or do more of. The fastest-growing occupation in the US over the next 10 years will be nurse practitioner, the US Bureau of Labor Statics announced. Fastest Growing Occupations · Wind turbine service technicians · Solar photovoltaic installers · Nurse practitioners · Data scientists · Information security. Question of the Day: What 3 jobs are projected to be the fastest growing over the next decade? years. After living in Texas, Colorado, Tennessee, and. The 20 Fastest Growing Jobs of the Next Decade · 1. Wind Turbine Service Technicians · 2. Nurse Practitioners · 3. Solar Photovoltaic Installers · 4. Occupational. Here are the most in-demand jobs in Virginia this year! OCCUPATION, JOB OPENINGS PER YEAR, ESTIMATED TOTAL EMPLOYMENT, 5-YEAR PERCENTAGE GROWTH, MEDIAN ANNUAL. 25 Fastest Growing Jobs in the U.S. · 1. Chief Growth Officer · 2. Government Program Analyst · 3. Environment Health Safety Manager · 4. Director of Revenue. The BLS predicts that there will be a rise of 68% in wind turbine technicians over the next ten years. Getting into this role requires the right qualifications. The Bureau of Labor Statistics of US has comprised a list of the occupations anticipated to be the fastest growing from through Electrical Engineer, then get a job working in power generation, then pick your next step. You could go back to school for an MBA, or do more of. The fastest-growing occupation in the US over the next 10 years will be nurse practitioner, the US Bureau of Labor Statics announced. Fastest Growing Occupations · Wind turbine service technicians · Solar photovoltaic installers · Nurse practitioners · Data scientists · Information security. Question of the Day: What 3 jobs are projected to be the fastest growing over the next decade? years. After living in Texas, Colorado, Tennessee, and. The 20 Fastest Growing Jobs of the Next Decade · 1. Wind Turbine Service Technicians · 2. Nurse Practitioners · 3. Solar Photovoltaic Installers · 4. Occupational. Here are the most in-demand jobs in Virginia this year! OCCUPATION, JOB OPENINGS PER YEAR, ESTIMATED TOTAL EMPLOYMENT, 5-YEAR PERCENTAGE GROWTH, MEDIAN ANNUAL. 25 Fastest Growing Jobs in the U.S. · 1. Chief Growth Officer · 2. Government Program Analyst · 3. Environment Health Safety Manager · 4. Director of Revenue.

Here is a list of 10 fastest growing careers in the Business Management & Administration career cluster with substantial job demand. Here are the most in-demand jobs in Virginia this year! OCCUPATION, JOB OPENINGS PER YEAR, ESTIMATED TOTAL EMPLOYMENT, 5-YEAR PERCENTAGE GROWTH, MEDIAN ANNUAL. fastest growing jobs ; 10 Well-Paying, Fast-Growing Jobs in Healthcare. Filed in Data and Technology, Data, Career Information, Employment Trends, Español · By. Fast Food and Counter Workers with a numeric change of 6, jobs, is projected to be the top growing occupation thru Home health and Personal Care. 1. Chief Growth Officer · 2. Government Program Analyst · 3. Environment Health Safety Manager · 4. Director of Revenue Operations · 5. Sustainability Analyst · 6. 32 in-demand jobs for the next ten years · 1. Home health aide · 2. Phlebotomist · 3. Grounds maintenance worker · 4. Nursing assistant · 5. Medical assistant. Projected ten-year population growth rates for the U.S. are %, with the projected working age population (age 16 and older) expected to grow at a rate of 1. Healthcare. Healthcare is one of the fastest growing sectors in Australia, with a predicted future growth of %. Among the occupations that are growing fastest are wind turbine techs, software developers and health care professionals. Those with both high demand and higher. In terms of the fastest-growing jobs with an average annual salary of $, or higher, medicine and IT are the top industries. Physicians' assistants; Nurse. Here are the top 10 occupations that are projected to grow the fastest in the next 10 years, according to the Bureau of Labor Statistics. 15 High-Paying Jobs That'll Be in Demand for Years to Come · 1. Nurse practitioner · 2. Data scientist · 3. Information security analyst · 4. Web developers · 5. Here is a list of 10 fastest growing careers in the Business Management & Administration career cluster with substantial job demand. Top 10 Fastest Growing Jobs in the Next 5 Years · Physician Assistants · 9. Data Scientists and Mathematical Science Occupations · 8. Medical and Health. Minning And whole manufacturing sector Further, some of these years ago, as did my father & grandparents. Many basic skills. Employment in the construction sector is projected to grow percent annually. This equates to million new jobs over the decade, the most among. Fastest Growing Occupations. Links below provide other data for this area , %, 16, 20, -1, 35, High school diploma or equivalent, $37, Fastest Growing Job Markets for MBA Grads · Computer and Information Systems Management · Financial Advising · Management Analytics · Construction Management. If you're looking for a job that's likely to be around a decade from now, read on for the fastest-growing occupations, ranked by their rate of projected growth. Nurse practitioners are among the fastest-growing occupations and are projected to increase by 46% over the decade. Physician assistants and healthcare.

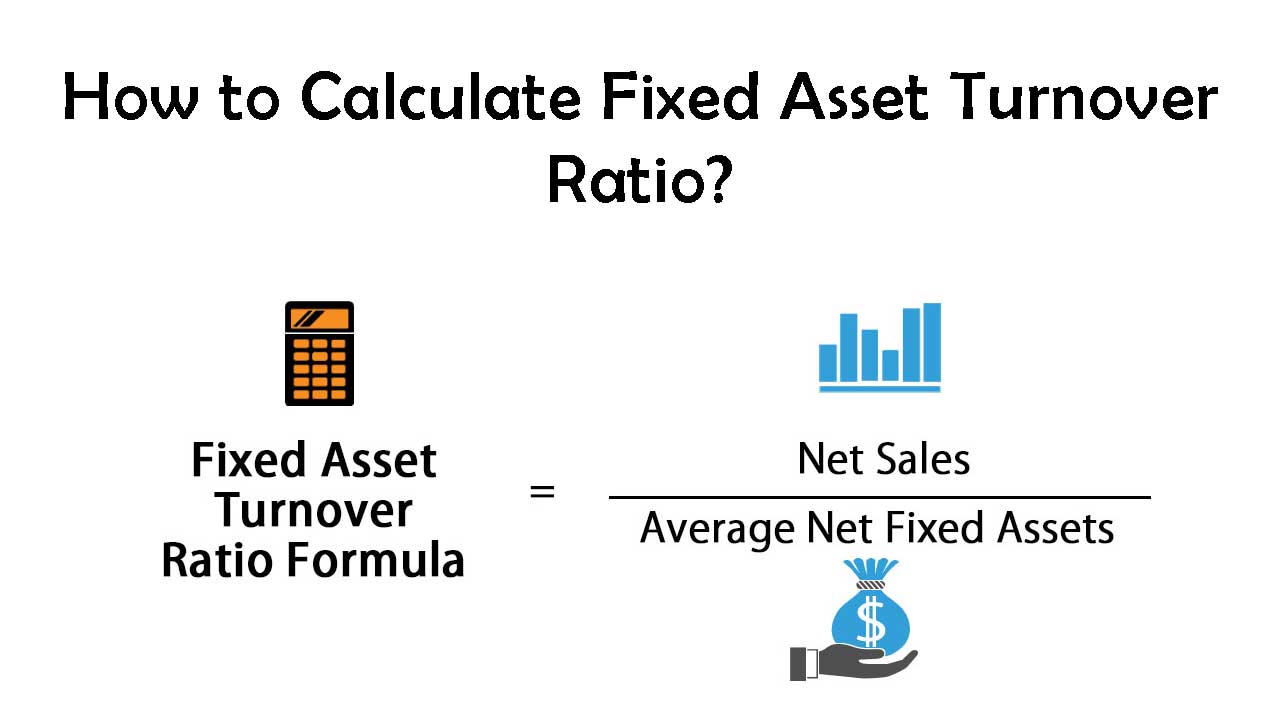

How To Calculate Asset Turnover

The ratio can be calculated by dividing gross revenue by the average of total assets. It should look like the following. asset turnover ratio = gross revenue ÷. Total Asset Turnover is a financial ratio that measures the efficiency of a company's use of its assets in generating revenue to the company. It is calculated. The asset turnover ratio formula is equal to net sales divided by the total or average assets of a company. A company with a high asset turnover ratio operates. The higher your ratio, the more money your business generates from its assets on average. Earlier, we established the general goal of >1. That “1” represents $1. The asset turnover ratio formula is equal to net sales divided by the total or average assets of a company. A company with a high asset turnover ratio operates. Fixed Asset Turnover (FAT) is an efficiency ratio that indicates how well or efficiently the business uses fixed assets to generate sales. The fixed asset turnover ratio formula is calculated by dividing net sales by the total property, plant, and equipment net of accumulated depreciation. Asset turnover equals total sales divided by average total assets. Image source: The Motley Fool. How to calculate asset turnover. The formula for calculating. In order to calculate the asset turnover ratio, you need to divide net sales by average total assets. The company's financial statement should provide the net. The ratio can be calculated by dividing gross revenue by the average of total assets. It should look like the following. asset turnover ratio = gross revenue ÷. Total Asset Turnover is a financial ratio that measures the efficiency of a company's use of its assets in generating revenue to the company. It is calculated. The asset turnover ratio formula is equal to net sales divided by the total or average assets of a company. A company with a high asset turnover ratio operates. The higher your ratio, the more money your business generates from its assets on average. Earlier, we established the general goal of >1. That “1” represents $1. The asset turnover ratio formula is equal to net sales divided by the total or average assets of a company. A company with a high asset turnover ratio operates. Fixed Asset Turnover (FAT) is an efficiency ratio that indicates how well or efficiently the business uses fixed assets to generate sales. The fixed asset turnover ratio formula is calculated by dividing net sales by the total property, plant, and equipment net of accumulated depreciation. Asset turnover equals total sales divided by average total assets. Image source: The Motley Fool. How to calculate asset turnover. The formula for calculating. In order to calculate the asset turnover ratio, you need to divide net sales by average total assets. The company's financial statement should provide the net.

The average fixed assets represent the mean value of the company's fixed assets listed on the balance sheet over a specific period. To calculate this, add up. What is the formula for fixed asset turnover? · Net revenue/net fixed assets (average of the two balance sheets) · Gross sales – sales returns · Net fixed assets. Thus, to calculate the asset turnover ratio, divide net sales or revenue by the average total assets. Here's the asset turnover rate formula that you can use in your calculations: Total Asset Turnover = Net Sales / Total Assets. The asset turnover ratio calculator helps you easily calculate the asset turnover ratio. Asset Turnover Ratio=Net Sales/Average Total Assets. The asset turnover ratio calculator helps you easily calculate the asset turnover ratio. Asset Turnover Ratio=Net Sales/Average Total Assets. Calculate the total asset turnover. Now that you have your net sales number and your average total asset number, you are ready to calculate your total asset. The fixed assets turnover ratio is a financial metric that measures the efficiency of a company in generating revenue from its investments in fixed assets. It. The numerator of the asset turnover ratio formula shows revenues which is found on a company's income statement and the denominator shows total assets which is. The asset turnover ratio is an efficiency ratio that measures a company's ability to generate sales from its assets by comparing net sales with average. The ratio can be calculated by dividing gross revenue by the average of total assets. It should look like the following. How to calculate asset turnover? Asset turnover is a metric that will help an organization understand how efficiently it is using its assets. The ratio is. Asset Turnover Ratio is a financial metric that helps businesses evaluate the efficiency of utilizing their assets to generate revenue. It is calculated by dividing the company's total revenue by its average total assets during a specific period. The ratio helps to assess how well a company uses. The calculation · Start by identifying and calculating the combined value of all of the assets within your business. · If possible, calculate your average total. How do you calculate the asset turnover ratio? To work out your ratio, divide your business's net sales by its total assets. (Your net sales are your gross. A fixed asset turnover ratio measures the efficiency of the company's net sales over its net fixed assets. Fixed asset turnover ratio= Net sales / Net fixed. So, what is the formula of this ratio? Well, according to the formula, you have to divide the net sales by the average total assets in order to get the asset. About the Formula. To calculate the asset turnover, you must first know your net sales. This is calculated by subtracting returns and allowances from gross. So, what is the formula of this ratio? Well, according to the formula, you have to divide the net sales by the average total assets in order to get the asset.

Best Medical Insurance Travel Abroad

VisitorsCoverage offers US visitor insurance, international travel medical insurance, trip insurance, and more. Compare travel insurance plans and buy. The insurance you need to travel to the USA as a tourist is visitors medical insurance. If you're traveling to the USA as an international student, you will. International travel medical insurance typically offers benefits that cover emergency medical, dental and evacuation services. Atlas Travel Insurance offers excellent short-term medical coverage for travelers abroad on short trips, vacations, or business trips. Trawick International Insurance · Trawick International · Nationwide Mutual Ins Company ; International Medical Group Insurance · International Medical Group. Travel medical & accident protection, offering pre-existing condition coverage, evacuation insurance: plans up to $1,, in medical benefits are available. Explore IMG's travel medical and travel health insurance insurance plans providing key benefits for international visitors, vacationers, & travelers. Whether you're going on a short vacation, traveling for work, or planning to live abroad, GeoBlue has coverage options to fit your needs. And since GeoBlue is. GeoBlue international medical insurance provides travelers with access to Blue Cross Blue Shield Travel health insurance coverage around the globe. VisitorsCoverage offers US visitor insurance, international travel medical insurance, trip insurance, and more. Compare travel insurance plans and buy. The insurance you need to travel to the USA as a tourist is visitors medical insurance. If you're traveling to the USA as an international student, you will. International travel medical insurance typically offers benefits that cover emergency medical, dental and evacuation services. Atlas Travel Insurance offers excellent short-term medical coverage for travelers abroad on short trips, vacations, or business trips. Trawick International Insurance · Trawick International · Nationwide Mutual Ins Company ; International Medical Group Insurance · International Medical Group. Travel medical & accident protection, offering pre-existing condition coverage, evacuation insurance: plans up to $1,, in medical benefits are available. Explore IMG's travel medical and travel health insurance insurance plans providing key benefits for international visitors, vacationers, & travelers. Whether you're going on a short vacation, traveling for work, or planning to live abroad, GeoBlue has coverage options to fit your needs. And since GeoBlue is. GeoBlue international medical insurance provides travelers with access to Blue Cross Blue Shield Travel health insurance coverage around the globe.

GeoBlue, part of the Blue Cross Blue Shield family, provides unsurpassed travel medical insurance. And as your health care advocate, they'll help you navigate. Travel insurance and assistance with UnitedHealthcare Global's SafeTrip international travel insurance plans - medical, accident, trip cancellation and. WorldMed Insurance will provide you with long-stay travel medical insurance coverage for up to 12 months. WorldTrips offers budget-friendly travel medical insurance and trip cancellation insurance plans for trips all over the globe. Get a quote today! Based on our research, the best international travel medical insurance plans come from Seven Corners, Tin Leg, and Faye (skip ahead to view these plans). Travel Guard's Deluxe Plan is a great option for international travelers because it has higher benefit limits and additional coverage options to cover your. Either way, some of the best travel health plans come from companies like Allianz Travel Insurance, GeoBlue, Seven Corners, Trawick International and WorldTrips. Safe Travels USA from Trawick is the best plan option for international citizens visiting the United States and other countries. In addition to those listed. The best health insurance for tourists in USA varies based on the best USA travel insurance for visitors plan chosen, however travelers can opt for coverage up. International travel insurance offers a range of medical benefits including coverage for hospitalization, emergency medical evacuation, and prescription. Generally, most domestic health insurance policies are not accepted abroad, so there is a benefit to purchasing travel medical insurance as a supplement to your. How to buy travel medical insurance. The best overall plan for travel medical insurance is Travel Medical from Seven Corners. This plan has the option for Covid. Features: Medical and Evacuation coverage with variable limits and great rates, especially for longer trips. Coverage for Terrorism, and Sports and Hazardous. If you're looking for stand-alone medical travel insurance, some of the top providers include IMG, Seven Corners, Atlas Travel Insurance and GeoBlue. There are. Compare Travel Insurance Plans from Our Trusted Providers. Top Services. back; Top Services; Birth Control Education · Bystander abroad – including medical insurance for emergent illness and injury while abroad. Travelex is the best overall travel insurance company because it offers coverage (up to % for interruptions) for you or your family members at a competitive. Expat insurance provides coverage for a longer period and complete health coverage while travel insurance is intended to cover short-term trips. Going abroad? Get travel medical coverage before your trip. Learn more about international health insurance costs to choose best option for your needs. Get travel insurance. Find out if your health insurance covers medical care abroad. Travelers are usually responsible for paying hospital and other medical.